Here’s the thing about the South Korea EV sector : it’s never just about the cars. It’s a whole ecosystem, a dance between innovation, policy, and, yes, even humble metals like aluminium. Newsflash: the demand for aluminium in South Korea is holding steady, despite some pretty significant shifts happening within their electric vehicle market. But why is this happening? What are these “diverging trends” everyone’s talking about? And what does it all mean for India, sitting here watching the global EV landscape evolve? Let’s dive in.

The Curious Case of Consistent Aluminium Demand

I initially thought this would be a simple story about supply and demand. More EVs, more aluminium, right? Not so fast. Electric vehicle production is certainly a major factor, but it’s only one piece of the puzzle. The article from JCK highlights how aluminium demand is projected to remain consistent despite a decline in overall automotive production in South Korea. This is due in large part to the increased use of aluminium in electric vehicles.

Here’s why this matters: aluminium is lighter than steel, which means EVs can be more energy-efficient. That translates to longer ranges and better performance – key selling points in a competitive market. But, the increasing preference towards LFP batteries in EVs are also affecting the dynamics of materials used in making of the EV’s. You can also get a sense of macro economic headwinds from here

What fascinates me is that it’s not just about replacing steel components with aluminium. It’s about redesigning entire vehicle structures to maximize the benefits of this lightweight metal. Think battery housings, chassis components, and even exterior panels. South Korean manufacturers are getting clever about how they use aluminium, which drives up the overall demand even if production numbers fluctuate a bit.

Diverging Trends | A Fork in the Road

So, what are these “diverging trends” causing all the buzz? Well, for starters, we’re seeing a shift in battery technology. While traditional lithium-ion batteries still dominate, there’s a growing interest in lithium iron phosphate (LFP) batteries. LFP batteries are cheaper and safer than their lithium-ion counterparts, but they also tend to be heavier. This could, theoretically, impact the demand for lightweight materials like aluminium. But, as the article suggests, that’s not enough to cause major fluctuations in aluminium demand.

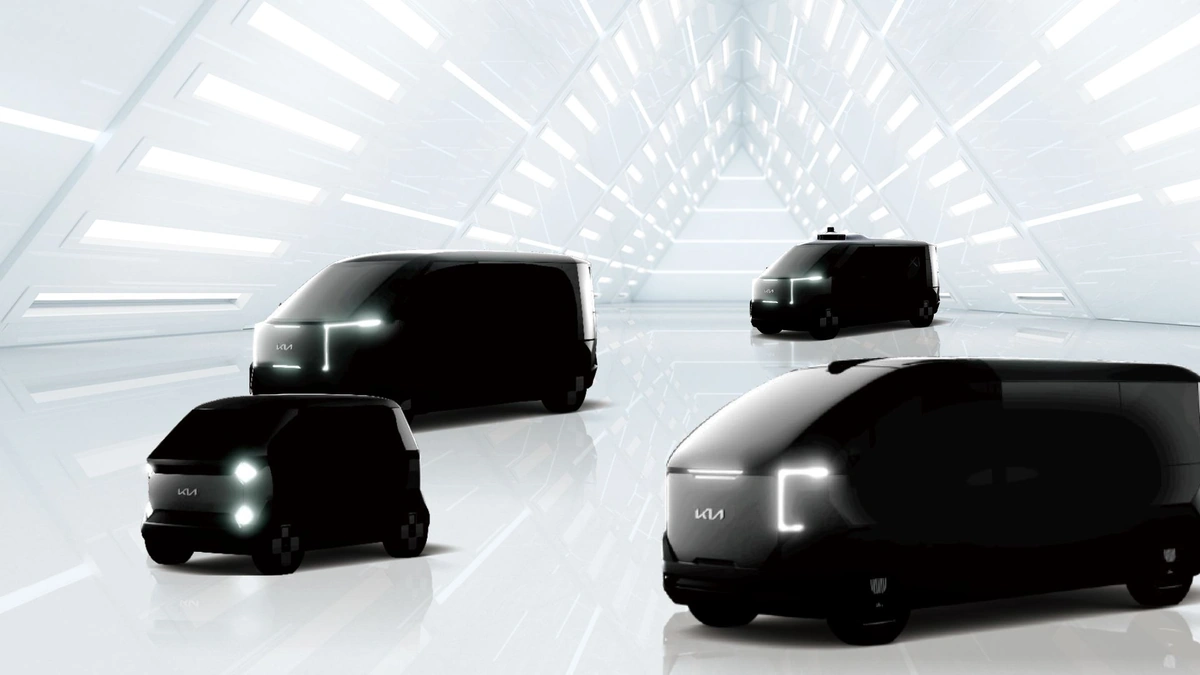

Another factor? Changing consumer preferences. Are people opting for smaller, more affordable EVs? Or are they still chasing after the high-end models with all the bells and whistles? This makes a difference because bigger, premium EVs tend to use more aluminium in their construction.

And then there’s the global supply chain. Remember those days of chip shortages and logistical nightmares? Those kinds of disruptions can throw a wrench into any industry, including the EV sector. Supply chain issues can affect production targets, material availability, and ultimately, the demand for aluminium. A common mistake I see analysts make is underestimating the sheer complexity of these interconnected factors.

Why This Matters to India (Yes, Really!)

Okay, so South Korea’s EV market is doing its thing. Why should we care here in India? Well, for several reasons. First, India’s own EV market is booming. We’re seeing a surge in electric two-wheelers, three-wheelers, and even cars. And guess what? Many of these vehicles rely heavily on aluminium for their lightweighting properties. Understanding the dynamics of the global aluminium market , particularly in a leading EV manufacturing hub like South Korea, gives us a sneak peek into what might happen here.

Second, Indian companies are increasingly looking to collaborate with South Korean firms in the EV space. Whether it’s battery technology, motor manufacturing, or vehicle design, there’s a lot of potential for cross-border partnerships. Knowing about the trends shaping the South Korean market can help Indian businesses make smarter investment decisions and forge stronger alliances. For example, understanding the revenue risks highlighted here could be helpful.

Third, the competition. It sounds obvious, but South Korea is a major player in the global EV race. And India wants to be a player, too! By studying their successes (and their challenges), we can learn valuable lessons about how to build a thriving and sustainable EV industry of our own. It is very important to note what’s happening in the electric vehicle sales here

The Future is Lightweight

Let’s be honest, the future of transportation is electric. And the future of EVs is, in many ways, intertwined with the future of materials like aluminium. While there might be short-term fluctuations and regional variations, the overall trend is clear: lightweighting is key to improving efficiency, extending range, and making EVs more appealing to consumers.

So, while the headlines might focus on battery technology and charging infrastructure, don’t underestimate the importance of humble metals like aluminium. They’re the unsung heroes of the EV revolution, quietly enabling a cleaner, greener, and more sustainable future for us all. Aluminium prices will also affect the sector in a big way. And it’s not just about cars – it’s about scooters, buses, trucks, and even airplanes. The demand for lightweight materials will only continue to grow as we electrify more and more aspects of our lives. The demand for aluminium for EVs will also have a multiplier effect on the economy.

FAQ Section

Will the increasing use of LFP batteries reduce aluminium demand?

While LFP batteries are heavier, the overall trend towards lightweighting in EVs is likely to sustain aluminium demand.

How does South Korea’s EV market affect India?

It provides valuable insights into global trends, partnership opportunities, and competitive strategies for India’s own EV industry.

What are the main drivers of aluminium demand in the South Korean EV sector?

Lightweighting requirements, battery housings, chassis components, and redesigning of vehicle structures.

Are there any risks to aluminium demand in the EV market?

Yes, supply chain disruptions and changes in consumer preferences (e.g., smaller EVs) could impact demand.

What is the role of electric vehicle components in sustaining aluminium demand?

The demand for EV components plays a role in sustaining aluminium demand.

What are the implications of the EV production trend on the aluminium sector?

The EV production trend impacts the aluminium sector by increasing the demand for aluminium in EV.