Investing in the stock market can feel like navigating a maze, especially when you’re trying to pick the right stocks. There’s a ton of information out there, and it’s easy to get lost in the noise. But here’s the thing: finding solid companies doesn’t have to be complicated. That’s where the price to sales ratio (P/S ratio) comes in – a simple, yet powerful tool that can help you spot potentially undervalued gems, like maybe even Automobile Corporation of Goa Limited. I remember when I first started, I was overwhelmed. Now, I look for simple metrics that cut through the noise – and the P/S ratio is one of my favorites.

But here’s the catch: relying on a single metric is like trying to build a house with just a hammer. You need a full toolbox. That’s where stop-loss strategies come into play, offering a safety net to protect your investments. So, let’s dive into how you can use these two tools together to make smarter investment decisions, specifically focusing on Automobile Corporation of Goa Limited. This isn’t just about numbers; it’s about building a strategy that aligns with your risk tolerance and investment goals.

Decoding the Price to Sales Ratio

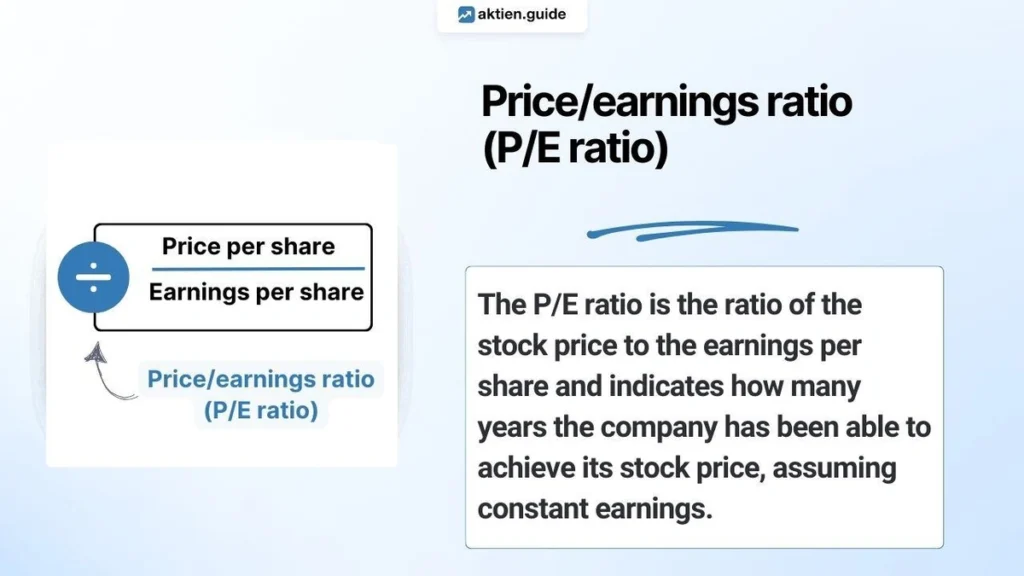

So, what exactly is the P/S ratio? Simply put, it compares a company’s market capitalization (the total value of its outstanding shares) to its total revenue (sales). The formula is straightforward: Price to Sales Ratio = Market Cap / Total Revenue. A lower P/S ratio generally suggests that a company might be undervalued, meaning you’re paying less for each rupee of sales the company generates. But (and this is a big ‘but’), it’s not a magic number. A low P/S ratio can also signal problems, like declining sales or intense competition. Let me rephrase that for clarity: A low P/S Ratio is not in and of itself an invitation to buy shares.

For Automobile Corporation of Goa Limited, understanding their P/S ratio can offer valuable insights. Let’s say their market cap is ₹500 crore and their total revenue is ₹1000 crore. Their P/S ratio would be 0.5. Now, you need to compare this to their industry peers. Are other auto component manufacturers trading at a higher P/S ratio? If so, Automobile Corporation of Goa Limited might be undervalued. You can find this information on financial websites likeMoneycontrolorNSE India.

However, don’t stop there. Consider why the P/S ratio is low. Is the company facing temporary headwinds, or are there deeper, structural issues? Has the company recently made a big announcement? Maybe Tesla is entering the Indian Market like discussed here impacting sales of other auto companies. Understanding the context is crucial. And that is where other indicators come in handy. If you dig a bit deeper and learn about Automobile PCB Balance Sheet it will help you to make better decisions.

Stop-Loss Strategies | Your Investment Safety Net

Okay, you’ve identified a potentially undervalued stock using the P/S ratio. Great! But before you jump in, let’s talk about protecting your downside. That’s where stop-loss orders come in. A stop-loss order is an instruction to your broker to sell a stock if it falls to a certain price. Think of it as an insurance policy for your investment. The most common mistake I see people make is not setting a stop-loss order at all. They get caught up in the potential upside and forget about the risk.

There are a couple of common types of stop-loss orders. A fixed percentage stop-loss involves setting a stop-loss at a certain percentage below your purchase price. For example, if you buy shares of Automobile Corporation of Goa Limited at ₹100 and set a 10% stop-loss, your order will trigger if the price falls to ₹90. Another approach is a trailing stop-loss, which automatically adjusts as the stock price rises. So, if the stock goes up to ₹120, your stop-loss would also rise proportionally, locking in some profits while still protecting against a downturn. Choosing the right type depends on your risk tolerance and investment style. What fascinates me is how people’s risk tolerance varies so widely.

Combining P/S Ratio and Stop-Loss | A Practical Approach

So, how do you use these two tools together? Here’s a practical approach. First, identify companies with attractive P/S ratios relative to their peers. Conduct thorough research to understand why the ratio is low. Is it a temporary blip, or a sign of deeper problems? Once you’ve identified a promising candidate like, say, Automobile Corporation of Goa Limited, determine your entry point and set a stop-loss order based on your risk tolerance. I initially thought this was straightforward, but then I realized the importance of regularly reviewing and adjusting your stop-loss levels.

A common mistake I see is setting the stop-loss too tight. If you set it too close to your entry price, you might get stopped out prematurely due to normal market fluctuations. On the other hand, setting it too wide exposes you to unnecessary risk. The key is to find the right balance. Consider the stock’s volatility and your investment time horizon. According to the latest data, the average volatility in the auto-ancillary sector is about 2%, so setting a stop loss beyond that could be considered too risky.

Also, keep an eye on news and developments related to Automobile Corporation of Goa Limited and the broader auto industry. Significant events, such as new product launches or changes in government regulations, can impact the stock price. Adjust your stop-loss levels accordingly. Remember, investing is not a set-it-and-forget-it activity. It requires ongoing monitoring and adjustments.

Advanced Strategies and Considerations

Beyond the basics, there are more advanced strategies you can employ. For example, you can use the P/S ratio in conjunction with other financial ratios, such as the price-to-earnings (P/E) ratio and the debt-to-equity ratio, to get a more comprehensive picture of a company’s financial health. And when it comes to setting stop-loss orders, you can use technical analysis tools, such as support and resistance levels, to identify optimal price points.

A word of caution: the P/S ratio is not a perfect metric. It doesn’t account for profitability or debt. A company with a low P/S ratio might still be unprofitable or heavily indebted. That’s why it’s crucial to use it in conjunction with other financial metrics and qualitative analysis. As per guidelines mentioned by SEBI , always diversify your portfolio, and do not invest solely based on one metric. It’s best to keep checking your broker’s portal.

Conclusion | Investing Wisely

Ultimately, investing is about making informed decisions. By understanding the price to sales ratio and implementing smart stop-loss strategies , you can increase your chances of success in the stock market. It’s like having a knowledgeable friend in the stock market, guiding you toward potentially undervalued opportunities while helping you protect your capital. Remember, there’s no guaranteed formula for success, but with the right tools and a disciplined approach, you can navigate the maze and build a portfolio that meets your financial goals. And remember to celebrate those small wins along the way!

FAQ Section

What is considered a good Price to Sales (P/S) ratio?

Generally, a P/S ratio below 1.0 is considered good, but it varies by industry. Compare it to industry peers.

How often should I adjust my stop-loss orders?

Review them regularly, especially after significant news events or earnings reports.

Can the P/S ratio be used for all types of companies?

It’s most useful for companies with consistent revenue, like those in the auto sector.

What if I forget to set a stop-loss order?

Set one immediately! It’s crucial for protecting your capital.

Is a lower P/S ratio always better?

Not necessarily. Investigate why the ratio is low before investing.

Where can I find the P/S ratio for Automobile Corporation of Goa Limited?

Financial websites like Moneycontrol or NSE India will have this data.