So, you’re eyeing Automobile Corp Goa, huh? Maybe you’ve heard whispers about its potential, or perhaps a friend casually mentioned the stock. But before you jump in headfirst, let’s talk about something crucial: the Price to Sales Ratio (P/S Ratio) . It’s not just another financial metric; it’s your radar for spotting value in a market that can often feel like a minefield.

What is the Price to Sales Ratio Anyway?

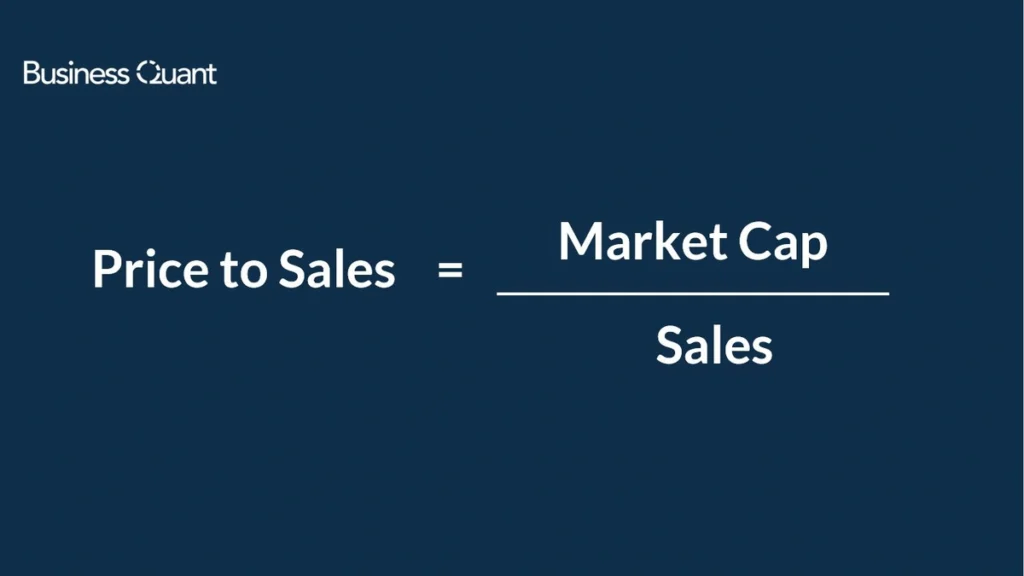

In simple terms, the Price to Sales Ratio compares a company’s market capitalization to its revenue. It tells you how much investors are willing to pay for each rupee of sales. The formula is straightforward: Market Cap divided by Total Revenue. A low P/S ratio might suggest that a stock is undervalued, while a high one could indicate it’s overhyped. But and this is a big ‘but’ it’s essential to understand the nuances.

Think of it like this: you’re at a roadside stall looking to buy mangoes. One vendor is selling them at ₹500 per dozen. Another sells almost identical mangoes at ₹300. Which one is potentially a better deal? The ₹300 vendor, right? The P/S ratio is similar – it helps you compare the “price” of revenue across different companies.

Why the P/S Ratio Matters for Automobile Corp Goa

Here’s the thing: Automobile Corp Goa operates in a cyclical industry. Auto sales fluctuate based on economic conditions, consumer sentiment, and a whole host of other factors. Using a metric like the P/S ratio can smooth out some of these cyclical bumps, offering a more stable view of the company’s valuation than, say, the Price-to-Earnings (P/E) ratio, which can be heavily influenced by short-term profitability.

Moreover, the P/S ratio is particularly useful when analyzing companies that aren’t yet profitable, or that have volatile earnings. For example, early-stage startups often have negative earnings, rendering the P/E ratio useless. But even a loss-making company has revenue, so the P/S ratio can still provide a useful benchmark.

I initially thought the P/S ratio was simply a quick and dirty valuation tool, but then I realized its real strength lies in its ability to provide context. It’s not a magic bullet, but it’s an invaluable piece of the puzzle.

Avoiding Value Traps | Beyond the Numbers

Okay, you’ve calculated the P/S ratio for Automobile Corp Goa and it looks attractive. Great! But don’t pop the champagne just yet. A low P/S ratio doesn’t automatically mean a stock is a bargain. It could be a value trap a stock that appears cheap but remains undervalued for a long time, potentially due to underlying problems within the company or industry.

So, how do you avoid these traps? Here’s how:

- Dig Deeper: Don’t rely solely on the P/S ratio. Examine other financial metrics like debt levels, cash flow, and profit margins.

- Industry Context: Compare Automobile Corp Goa’s P/S ratio to its peers. A low P/S might be normal for the industry.

- Qualitative Factors: Consider the company’s management, competitive landscape, and future growth prospects. What’s their market share? Are they innovating?

A common mistake I see people make is treating the P/S ratio in isolation. It’s just one data point in a much larger picture. You need to understand why the ratio is what it is.

Trading Alerts | Spotting Opportunities and Risks

Now, let’s talk about trading alerts. The P/S ratio can generate useful buy and sell signals, but it needs to be used in conjunction with other indicators and a solid understanding of market dynamics.

- Buy Signal: If Automobile Corp Goa’s P/S ratio is significantly lower than its historical average and its peers, and the company’s fundamentals are sound, it might be a buying opportunity.

- Sell Signal: Conversely, if the P/S ratio is unusually high, especially compared to its growth rate, it could be a sign to take profits or reduce your position.

Remember, these are just alerts, not guarantees. Market sentiment, unexpected news, and macroeconomic factors can all influence stock prices, regardless of the P/S ratio.

Let me rephrase that for clarity: Trading alerts based on the P/S ratio are like weather forecasts. They give you an indication of what might happen, but they’re not always right. Manage your risk accordingly.

The Automotive Sector & P/S Ratio | Additional Factors

Analyzing the P/S Ratio in the automotive sector requires understanding industry-specific nuances. For example, high capital expenditure is common, impacting profitability. Therefore, compare Automobile Corp Goa to companies with similar business models. Also, keep an eye on evolving market dynamics such as electric vehicle (EV) adoption and regulatory changes which can influence revenue projections. Tracking these factors alongside the P/S ratio provides a more comprehensive investment perspective. Consider how well the company manages its supply chain and adapts to technological advancements.

Always consider these macroeconomic factors when deciding whether the stock is a good investment, especially with the fluctuating sales in the Indian Auto Industry

Conclusion | The P/S Ratio – Your Compass, Not Your Destination

The Price to Sales Ratio is a valuable tool for assessing Automobile Corp Goa, particularly in a cyclical industry like automobiles. It offers a relatively stable valuation metric, helps you spot potential value traps, and can generate useful trading alerts. But it’s crucial to remember that it’s just one piece of the puzzle. Don’t rely on it in isolation. Do your homework, understand the company, and consider the broader market context. Think of the P/S ratio as a compass – it points you in the right direction, but you still need to navigate the terrain yourself.

And what fascinates me is that even the most seasoned investors sometimes overlook these fundamental principles. They get caught up in the hype, the headlines, and the quick gains. But in the long run, it’s the disciplined, informed investors who come out on top.

FAQ Section

What is considered a good Price to Sales Ratio?

Generally, a P/S ratio below 1.0 is considered good, but it varies by industry. Compare to industry averages for a better benchmark.

Can the P/S ratio be used for any company?

It’s most useful for companies with consistent revenue, including those with volatile earnings or those not yet profitable.

What are the limitations of using the P/S ratio?

It doesn’t consider debt, expenses, or profitability. Use with other ratios for a comprehensive analysis.

How often should I check the P/S ratio of a stock?

Review it periodically, especially during earnings releases or significant company announcements.

Where can I find the Price to Sales Ratio?

Sites like Yahoo Finance, Google Finance, and other financial portals usually list the P/S ratio.

To understand more about similar companies you can also check other brands like Chevrolet Aveo