Ever wonder where the pros are putting their money in today’s crazy market? Well, Mihir Vora, a big name at Trust Mutual Fund , recently dropped some knowledge bombs about where he sees potential in AI stocks, banking, auto, and IT. Let’s be honest, navigating the Indian stock market can feel like trying to solve a Rubik’s Cube blindfolded. So, let’s break down what Mr. Vora had to say, why it matters, and how it might influence your own investment decisions. Forget the jargon; we’re keeping this real.

Decoding Mihir Vora’s Investment Thesis

So, what’s the big picture here? Vora’s insights aren’t just random stock picks; they reflect a carefully considered view on the Indian economy and its future. He’s not just throwing darts at a board; there’s a strategy at play. According to reports, his analysis suggests a bullish outlook on specific sectors poised to benefit from India’s growth story. But the trick is understanding why these sectors are getting the nod. The “why” usually boils down to government policies, technological advancements, and changing consumer behavior. A good understanding of factors influencing investment strategies can help you make informed decisions about your finances.

AI Stocks | The Future is Now (But Proceed with Caution)

AI is the buzzword that just won’t quit, right? Vora’s take on artificial intelligence (AI) stocks is particularly interesting. He likely sees them as more than just hype; they represent companies building the infrastructure for India’s technological future. But – and this is a BIG but – not all AI stocks are created equal. A common mistake I see people make is assuming any company with “AI” in its name is a goldmine. A careful investor should look into the financials, innovation, and sustainability of these companies. What fascinates me is how AI is rapidly transforming how businesses operate in India.

Banking, Auto, and IT | The Pillars of the Indian Economy

Beyond the shiny new toy that is AI, Vora also touches on the more established sectors: banking, auto, and IT. These are the workhorses of the Indian economy, and understanding their trajectory is key to smart investing. Here’s the thing: each of these sectors faces unique challenges and opportunities. For example, the Indian banking sector is currently navigating tighter regulations and increased competition from fintech companies. But, and this is important, they’re also benefiting from increased financial inclusion and a growing middle class. You can find more information on the financial inclusion on theReserve Bank of India’s website. It’s a balancing act, and Vora’s insights likely reflect an understanding of these nuances.

The Importance of Due Diligence in Mutual Fund investments

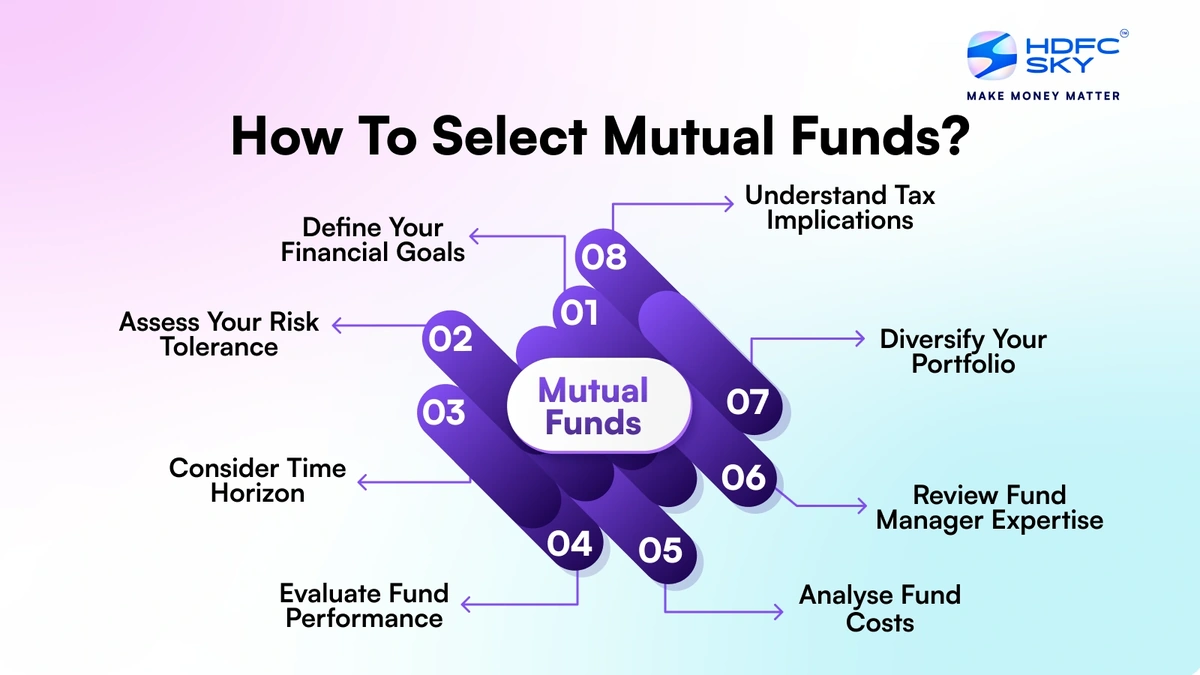

Okay, let’s be brutally honest: investing is risky. There are no guarantees, and anyone who tells you otherwise is probably trying to sell you something. That’s why due diligence is so important. Don’t just blindly follow Vora’s picks (or anyone else’s, for that matter). Do your homework. Understand the companies you’re investing in, and consider your own risk tolerance. A common mistake I see people make is investing in something they don’t understand. Remember, risk management is crucial.

One strategy you can implement is diversifying your portfolio. You could diversify your portfolio by investing in different asset classes and sectors. Diversification helps to mitigate risk and can improve your overall returns. It’s like not putting all your eggs in one basket.

Speaking of vehicles, are you thinking of buying a new car? Consider these Honda Cheapest Cars in India.

Actionable Takeaways for the Indian Investor

So, what does all of this mean for you, the average Indian investor? Here’s my take: Vora’s insights are valuable, but they’re just one piece of the puzzle. Don’t treat them as gospel; treat them as a starting point for your own research. Consider his sector preferences (AI, banking, auto, IT), but dig deeper. Understand the specific companies within those sectors, and assess their long-term potential. And most importantly, align your investments with your own financial goals and risk tolerance.

Remember that the stock market can be influenced by economic trends and geopolitical factors. Keep an eye on national and global happenings that can affect your investment decisions. Also, take into account the market volatility; it can change frequently, and be prepared for fluctuations in the value of your investments.

FAQ Section

Frequently Asked Questions

What exactly is a mutual fund?

A mutual fund is a pool of money collected from many investors to invest in securities like stocks, bonds, or other assets. It is operated by professional money managers.

How do I start investing in mutual funds in India?

You can start by opening a Demat and trading account, completing your KYC, and choosing a mutual fund scheme that aligns with your investment goals. Platforms like Groww, Zerodha, and Paytm Money offer easy ways to invest.

What are the risks associated with mutual fund investments?

Market risk, interest rate risk, and credit risk are some of the risks. Mutual Fund investments are subject to market risks, read all scheme-related documents carefully. These depend on the type of securities the mutual fund invests in.

What should I consider before investing in a mutual fund?

Consider your investment goals, risk tolerance, investment horizon, and the fund’s past performance, expense ratio, and fund manager’s expertise. The best thing to do is consult with a financial advisor.

How do I track the performance of my mutual fund investments?

You can track your investments through the fund’s website, your broker’s platform, or consolidated account statements. Monitoring regularly will help you assess if the investment is meeting your objectives.

Ultimately, successful investing is about combining expert insights with your own critical thinking. It’s about understanding the ‘why’ behind the ‘what,’ and making informed decisions that align with your unique financial journey. Don’t blindly follow the herd. Be a smart, informed, and confident investor.

Thinking of future goals? Check out the Latest Vivo X200 FE 5G.