Let’s be honest, deciphering the stock market can feel like trying to understand the rules of cricket when you’ve only ever watched kabaddi. It’s a whole different ball game. When it comes to companies like Resourceful Automobile Limited, you’re not just looking at their sales figures or new car models. You’re diving into the fascinating (and sometimes frustrating) world of market correlation, price support levels, and how they’re expanding their reach. Why should you care? Because understanding these elements is key to seeing the bigger picture – not just for investors, but for anyone interested in the Indian economy and where it’s headed.

Think of it this way: following a single company is like watching one ant in a colony. Interesting, maybe, but you don’t really grasp the ant colony’s whole operation. To get that, you need to understand how the ants (different companies and sectors) interact with each other and the environment (the market). So, let’s put on our analyst hats and delve into the factors influencing Resourceful Automobile Limited’s journey. Let’s get started!

Decoding Market Correlation: It’s All About Relationships

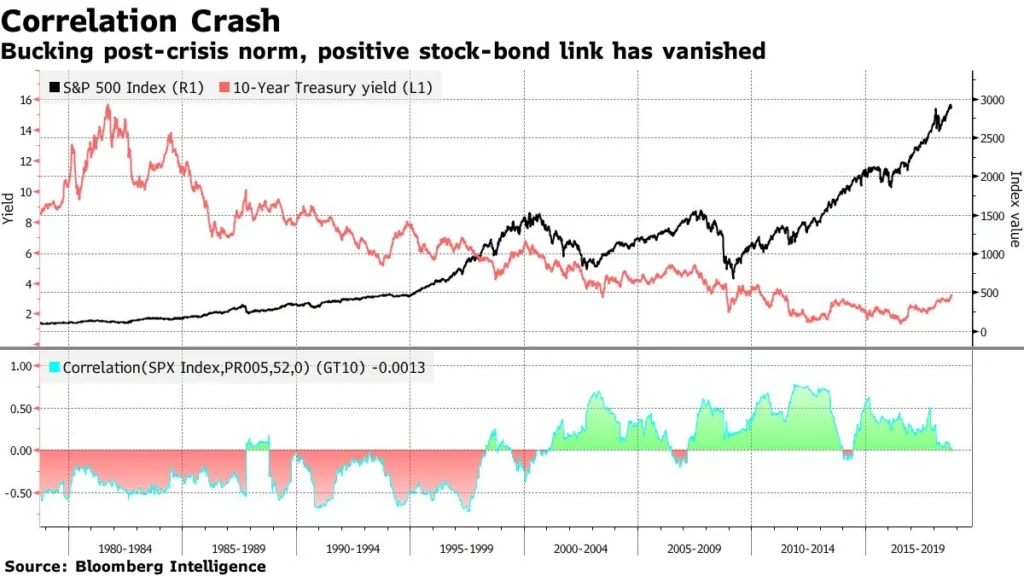

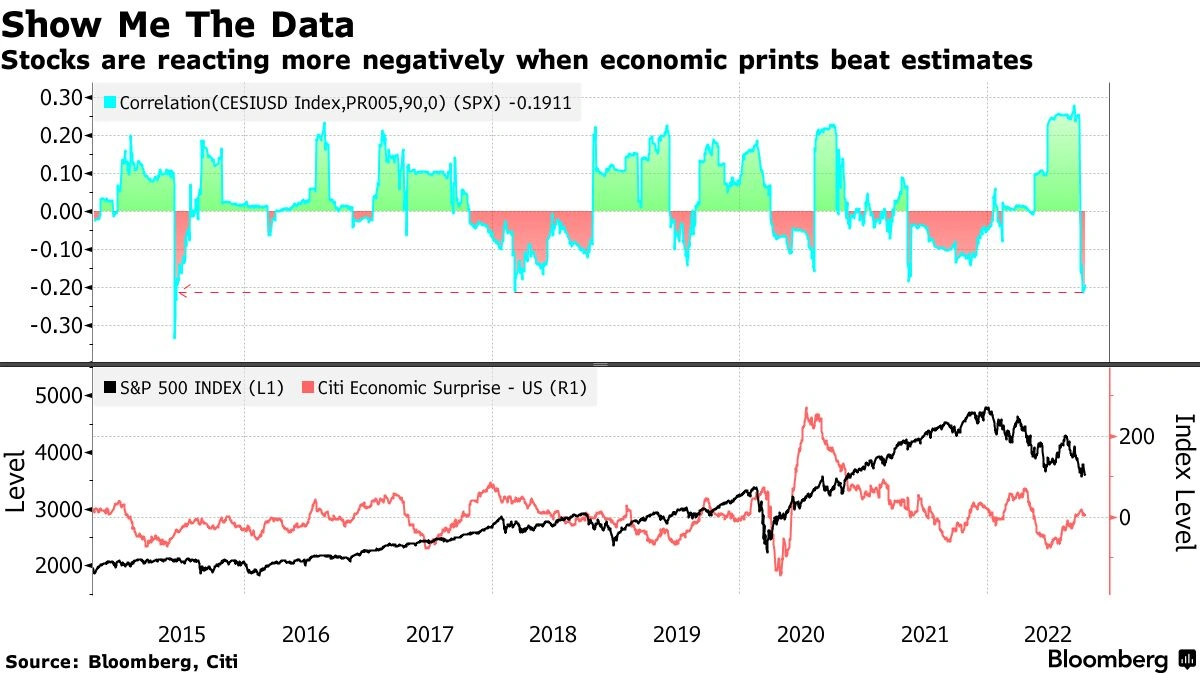

What even is market correlation ? Simply put, it’s how the movement of one asset (in our case, Resourceful Automobile Limited’s stock) relates to the movement of another asset or the market as a whole. A positive correlation means they tend to move in the same direction. A negative correlation means they move in opposite directions. Zero correlation? Well, they’re doing their own thing, oblivious to each other. The auto sector’s stock market trends significantly impact individual players like Resourceful Automobile.

Why is this crucial? Imagine you’re an investor. If Resourceful Automobile Limited’s stock is highly correlated with the overall auto sector, and the auto sector is tanking, you can probably expect Resourceful to feel the pain too. But, (and this is a big ‘but’), if Resourceful has managed to decouple itself – meaning it’s performing well despite the sector’s woes – that’s a sign of underlying strength and potentially a good investment. Understanding market correlation is about identifying such anomalies and understanding the ‘why’ behind them.

For instance, factors like raw material price fluctuations can affect the entire auto sector, leading to high correlation between different companies. However, a company with strong brand loyalty and innovative products might weather the storm better, reducing its correlation with the rest of the pack. This company specific risk requires investors to evaluate multiple factors and not just trends.

Price Support Levels | Finding the Safety Net

Price support levels are like the ground floor of a building. They represent a price point where a stock has historically found buying interest, preventing it from falling further. Think of it as a psychological barrier for investors – a level where they believe the stock is undervalued and are willing to step in and buy.

Now, here’s the thing: these levels aren’t set in stone. They’re based on past performance and investor sentiment. If Resourceful Automobile Limited’s stock consistently bounces back from, say, ₹500, that becomes a key price support level to watch. If it breaks through that level, it could signal further declines. Alternatively, a strong bounce off the support level could indicate renewed investor confidence. Keeping tabs on these levels is essential for making informed decisions about when to buy or sell.

What fascinates me is how these levels often become self-fulfilling prophecies. The more people believe a stock will bounce at a certain price, the more likely it is to actually happen. It’s a classic example of how psychology plays a massive role in the stock market. Various technical analysis indicators can help determine these price floors.

Portfolio Expansion | Planting Seeds for the Future

Portfolio expansion isn’t just about adding more cars to Resourceful Automobile Limited’s lineup. It’s about strategic growth – entering new markets, launching innovative products, or diversifying into related businesses. This is also impacted by the automotive industry growth projections. A well-diversified portfolio can act as a hedge against market volatility and ensure sustained growth in the long run.

For example, if Resourceful is heavily reliant on the sedan market and that market starts to decline, the company is vulnerable. But, if they’ve been smart and expanded into the SUV or electric vehicle segments, they’re better positioned to weather the storm. It’s like planting seeds in different fields – if one crop fails, you’ve got others to fall back on.

What’s particularly interesting is how portfolio expansion strategies can influence a company’s market correlation . A company that’s too focused on one segment might become highly correlated with the performance of that segment. Diversification can reduce this correlation, making the company’s stock less susceptible to sector-specific downturns. You can see a case studyof this with other companies.

Long-Term Strategy and Sustainable Growth

All of this market correlation , price support, and portfolio expansion ties into one central theme: long-term strategy. Resourceful Automobile Limited isn’t just trying to make a quick buck; they’re building a sustainable business that can thrive through market cycles. A company that proactively manages these three areas demonstrates a clear understanding of the market dynamics and a commitment to long-term value creation.

For us in India, this means more than just seeing a company’s stock price go up. It means seeing the company contribute to job creation, technological innovation, and overall economic growth. It’s about investing in a future where Indian companies are not just surviving, but thriving on the global stage. The Indian automotive sector’sfuture relies on firms making smart calculated risks.

So, the next time you hear about Resourceful Automobile Limited, don’t just look at the headlines. Dig a little deeper. Understand the market correlation , identify the price support levels, and assess their portfolio expansion strategy. You might just be surprised at what you discover and how it informs the market dynamics.

FAQ Section

Frequently Asked Questions

How can I track market correlation for Resourceful Automobile Limited?

Financial websites like Economic Times or Screener provide correlation matrices. Compare Resourceful’s stock movement with benchmark indices like Nifty Auto to gauge the correlation.

What happens if a price support level is broken?

Breaking below a key price support level suggests further downward pressure. It might be a signal to reduce your holdings or wait for a new support level to form before buying.

How does portfolio expansion benefit a company like Resourceful Automobile Limited?

Expansion reduces dependence on a single product line or market. This diversification cushions the impact of downturns in specific segments and provides new growth avenues.

Where can I find information about Resourceful Automobile Limited’s expansion plans?

Company announcements, annual reports, and press releases are good sources. Financial news websites also cover expansion plans and strategic initiatives.

Why is understanding technical analysis indicators important for investors?

They help identify potential entry and exit points by analyzing price patterns and volume data. Indicators can provide insights into investor sentiment and future price movements.

Can market correlation alone determine investment decisions?

No, it’s just one factor. Consider company fundamentals (revenue, profits, debt), industry trends, and overall economic conditions. Market correlation provides context, not a guaranteed outcome.