Let’s be honest, dealing with automobile insurance can feel like navigating a minefield. You’re paying your premiums, hoping you never need it, but knowing that if something does happen, you’ll be wading through paperwork and potential headaches. But what if the headache isn’t just from the accident? What if you’re a victim of insurance fraud ?

That’s where the clever folks using data science come in. Forget hunches and gut feelings; we’re talking about algorithms and machine learning models that can sniff out suspicious claims faster than you can say “deductible.” And recently, I stumbled upon some exciting research using a very specific approach: penalty-based feature selection, particle swarm optimization, and machine learning. Sounds complicated, right? Let’s break down why this matters.

The Rising Tide of Insurance Fraud: Why We Need Better Detection

Here’s the thing: Insurance fraud isn’t just some victimless crime. It affects everyone. It drives up premiums for honest policyholders, and it diverts resources that could be used to process legitimate claims more efficiently. Think of it as a slow leak in the system, slowly draining the value for everyone involved. The Association of British Insurers estimates that fraudulent claims add, on average, £50 to the annual insurance bill of every honest policyholder. While that statistic comes from the UK, the problem is global.

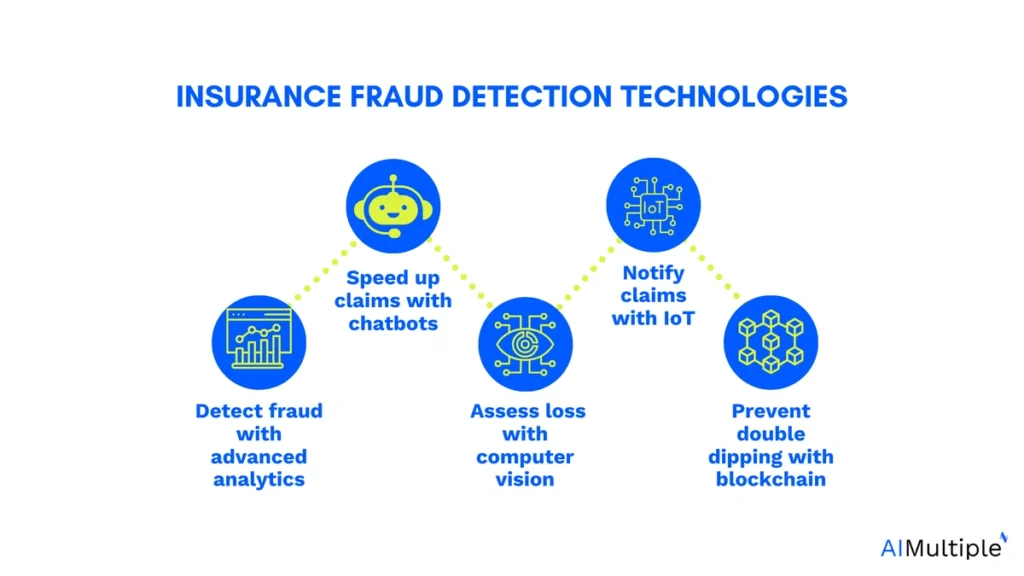

Traditionally, insurance companies have relied on manual investigations, which are time-consuming and prone to human error. A skilled fraudster can often slip through the cracks. This is where machine learning enters the picture. Machine learning algorithms can analyze vast amounts of data – claim histories, accident reports, even social media activity – to identify patterns and anomalies that would be impossible for a human to detect. But simply throwing data at a machine learning model isn’t enough. You need to be smart about which data you use and how you train the model. That’s where feature selection and optimization come in.

Decoding the Tech | Penalty-Based Feature Selection and Particle Swarm Optimization

Okay, let’s untangle this a bit. Feature selection, in simple terms, is about choosing the most relevant pieces of information (features) to feed into the machine learning model. Imagine you’re trying to bake a cake, but you have a whole pantry full of ingredients. Do you need all of them? No. You need the flour, sugar, eggs, and maybe some vanilla. The rest is just noise. Penalty-based feature selection is a technique that automatically identifies and prioritizes the most important features for detecting insurance fraud , while penalizing those that are irrelevant or misleading.

Now, what about particle swarm optimization? This is where things get really interesting. Particle swarm optimization (PSO) is a computational method that mimics the social behavior of swarms – like a flock of birds or a school of fish – to find the best solution to a problem. In this case, the “problem” is to fine-tune the parameters of the machine learning model to achieve the highest possible accuracy in detecting insurance fraud . The “particles” in the swarm represent different possible configurations of the model, and they communicate with each other to collectively explore the solution space and converge on the optimal solution.

Think of it this way: You have a group of people searching for the best hiking trail to a hidden waterfall. Each person explores a different path, but they share information about their progress with the group. The group collectively learns which paths are promising and which are dead ends, and eventually they all converge on the best trail to the waterfall. PSO works in a similar way, but with mathematical equations instead of hikers and trails.

Machine Learning Models | The Brains Behind the Operation

So, you’ve got your carefully selected features and your finely tuned model. Now it’s time to put it to work. The research in question likely experimented with different types of machine learning models, such as:

- Logistic Regression: A simple but effective model for predicting binary outcomes (fraudulent or not fraudulent).

- Support Vector Machines (SVMs): A powerful model that can handle complex data patterns.

- Random Forests: An ensemble learning method that combines multiple decision trees to improve accuracy and robustness.

- Neural Networks: Sophisticated models inspired by the structure of the human brain, capable of learning highly non-linear relationships in the data.

The key is to choose the model that best fits the specific characteristics of the insurance fraud data. This often involves a process of trial and error, where different models are trained and evaluated on a test dataset to determine which one performs the best.

Impact on the Indian Automobile Insurance Landscape

Why should someone in India care about this research? Because insurance fraud is a significant problem in India, just like it is globally. A 2023 report by the General Insurance Council of India estimated that fraud accounts for approximately 5-10% of all claims. Implementing these advanced fraud detection techniques, like machine learning , can save insurance companies significant amounts of money, which can then be passed on to consumers in the form of lower premiums.

Moreover, it can help to create a fairer and more efficient insurance system, where legitimate claims are processed quickly and fraudulent claims are detected and prevented. This could lead to faster claim settlements and improved customer satisfaction. It also means more resources can be allocated to improving services for genuine claimants, rather than chasing down fraudsters. In areas like fraudulent accident claims and inflated repair bills, these technologies can be incredibly effective. Early fraud detection can also significantly reduce the risk of larger, more complex fraud schemes.

And let’s not forget the potential for job creation. As insurance companies adopt these new technologies, they’ll need skilled data scientists, machine learning engineers, and fraud analysts to implement and maintain them. This would open doors for tech professionals and could help reduce unemployment. For example, consider the potential improvements to the Motor Third Party Claims Tribunal (MTPCT) process through efficient identification of suspect claims.

The Future of Insurance Fraud Detection

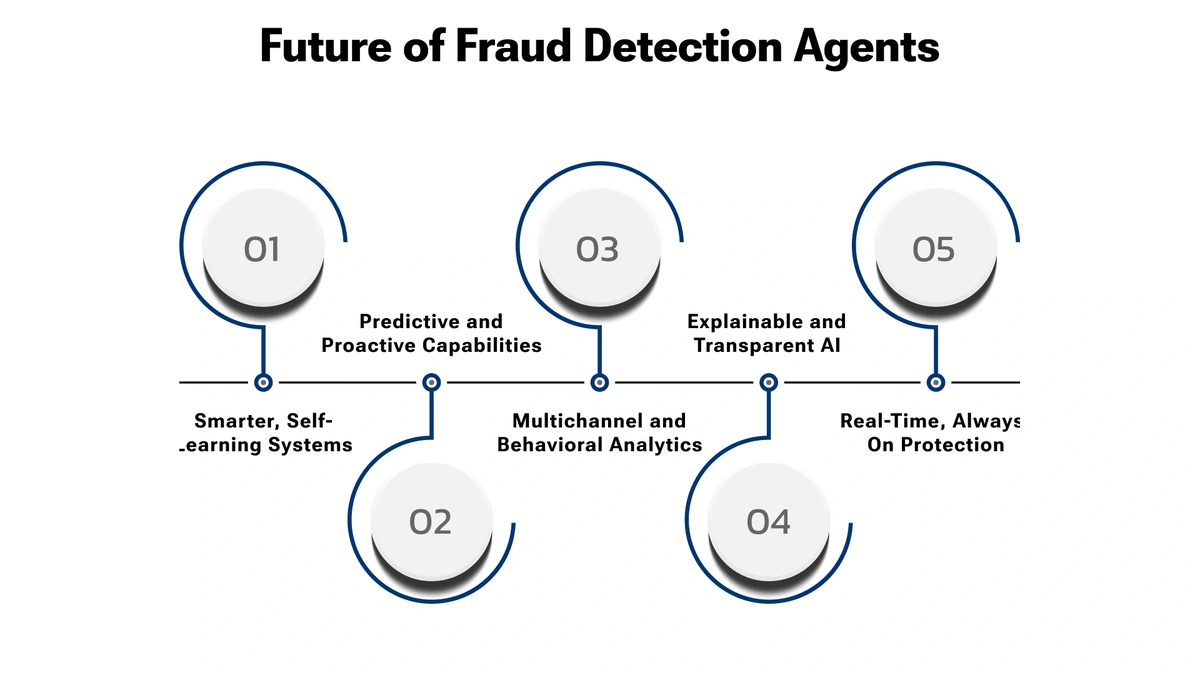

What’s next? Well, the field of insurance fraud detection is constantly evolving. As fraudsters become more sophisticated, so too must the techniques used to catch them. I imagine we’ll see even more advanced machine learning models, incorporating techniques like deep learning and natural language processing, to analyze increasingly complex data sources. We might also see more collaboration between insurance companies and law enforcement agencies to share information and coordinate efforts to combat insurance fraud . The goal isn’t just to catch fraudsters after the fact, but to prevent fraud from happening in the first place.

One thing to keep in mind – and this is crucial – is the ethical implications of using these technologies. We need to ensure that these algorithms are fair, transparent, and unbiased, and that they don’t discriminate against certain groups of people. Transparency is vital. Also, policyholders must be reassured that their data is being used responsibly and ethically.

FAQ: Your Questions About Insurance Fraud Detection Answered

Frequently Asked Questions

What exactly is insurance fraud?

Insurance fraud happens when someone intentionally deceives an insurance company for financial gain. This can include faking accidents, exaggerating injuries, or submitting false claims.

How does machine learning help detect fraud?

Machine learning algorithms can analyze large datasets to identify patterns and anomalies that indicate potentially fraudulent claims. They can detect inconsistencies and red flags that humans might miss.

What are the benefits of using these techniques?

The benefits include reduced losses for insurance companies , lower premiums for honest policyholders, faster claim processing, and a fairer insurance system overall.

Are these fraud detection methods accurate?

While these methods are generally accurate, no system is perfect. There’s always a risk of false positives (incorrectly flagging a legitimate claim as fraudulent) or false negatives (failing to detect a fraudulent claim). Careful model developmentand validation are crucial.

Is my personal data safe when these systems are used?

Insurance companies have a responsibility to protect your personal data. They should implement appropriate security measures to prevent unauthorized access and misuse. You should always read the insurance company’s privacy policy to understand how your data is being used.

Can I be wrongly accused of fraud by these systems?

It’s possible, but unlikely. If your claim is flagged as potentially fraudulent, the insurance company should conduct a thorough investigation before making any decisions. You have the right to appeal any decision you believe is unfair. It is best to keep all communication with your insurer open and honest.

In conclusion, the use of penalty-based feature selection, particle swarm optimization, and machine learning represents a significant step forward in the fight against automobile insurance fraud . It’s not just about catching criminals; it’s about creating a fairer, more efficient, and more trustworthy insurance system for everyone. And what fascinates me is how this technology, initially developed for complex engineering problems, is now helping to protect everyday people from the financial burden of fraud. The potential is huge, and I’m excited to see how these techniques continue to evolve and improve in the years to come. This technology is not just a tool for insurance companies ; it’s a way to protect all consumers. For more information, you can read this article about the future of fraud management . And remember to always keep your policy documents in a safe place. If you want to learn more about electric vehicles, click here.