Let’s be honest, deciphering the stock market is like trying to understand the offside rule in football – confusing, right? But sometimes, a company’s moves are so bold, so clearly telegraphed, that even I can see the potential. Today, we’re diving deep into Resourceful Automobile Limited and its apparent push for geographic expansion . Is it a calculated risk or a masterstroke? Let’s find out, from an Indian perspective.

The “Why” Behind Resourceful Automobile’s Ambitions

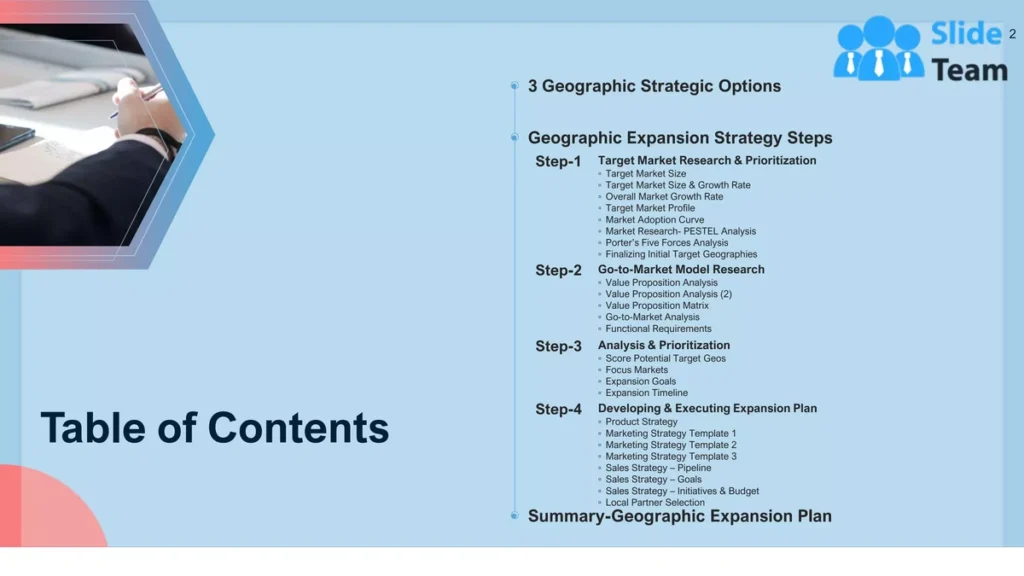

So, why is Resourceful Automobile Limited even considering expanding geographically ? Well, a few reasons jump out. The Indian market, while massive, can be incredibly competitive. Think of it as a crowded street food stall – everyone’s vying for the same customers. Geographic diversification reduces reliance on a single market, mitigating risk. This is crucial especially in the volatile automobile industry, which is subject to changing regulations and fluctuating consumer demand. Think of it as not putting all your samosas in one basket.

But there’s more to it than just risk management. Expanding into new territories opens up access to new customer bases, increased sales volumes, and potentially higher profit margins. For example, a company might find that a particular model sells exceptionally well in a specific region due to local preferences or needs. This could drive market penetration in key demographics. Plus, different regions have different regulatory environments. Resourceful Automobile might be strategically positioning itself to take advantage of more favorable policies or incentives elsewhere, such as tax benefits for electric vehicle production. According to a report by the Automotive Research Association of India (https://www.araiindia.com ), many companies are seeing huge opportunities for growth with the right investments.

And don’t forget the signaling effect. Announcing a global expansion strategy can boost investor confidence. It suggests that the company is ambitious, forward-thinking, and confident in its ability to compete on a larger stage. But it’s not enough. It also needs competitive advantages for long-term growth. Here’s a link to an article about partnerships that help drive that competitive edge.

Navigating the Stop-Loss Strategies for Auto Stocks

Now, let’s talk brass tacks. The stock market, as any seasoned investor knows, can be a rollercoaster. And while geographic expansion might sound exciting, it also introduces new risks. That’s where stop-loss strategies come in handy. A stop-loss order is essentially an instruction to your broker to sell a stock when it reaches a certain price. It’s like setting a safety net to protect your investments from significant losses. I’ve seen too many investors ignore this basic principle and then lose their shirts.

There are several approaches to setting stop-loss orders. A common one is to use a fixed percentage below your purchase price. For instance, if you bought Resourceful Automobile at ₹500, you might set a stop-loss at ₹450, representing a 10% decline. Another approach is to use technical analysis, looking at support levels and moving averages to identify potential price floors. The key is to choose a strategy that aligns with your risk tolerance and investment horizon. I initially thought stop-loss orders were overly cautious, but after seeing the market turbulence during the pandemic, I’m a convert.

But remember, stop-loss orders aren’t foolproof. In a rapidly declining market, your order might be executed at a price significantly lower than your stop-loss level – a phenomenon known as slippage. It’s also important to adjust your stop-loss levels periodically as the stock price rises, locking in profits and protecting against potential downturns. You also need to consider factors like market volatility when evaluating these stocks. The market’s reaction to Resourceful Automobile’s international expansion plans will be something to watch closely.

Key Financial Metrics and Expansion Costs

Before jumping on the bandwagon, let’s crunch some numbers. What are the key financial metrics to watch when evaluating Resourceful Automobile’s expansion plans? Revenue growth, obviously. But more importantly, keep an eye on profitability. Is the company generating enough cash to fund its expansion without taking on excessive debt? Debt-to-equity ratio is an important metric to examine, which can show if the company is too leveraged.

Expansion also entails significant costs. Setting up new manufacturing facilities, establishing distribution networks, and adapting products to local market preferences all require substantial investment. These are all part of the capital expenditure needed for such a move. These are substantial and can impact the share price. And let’s not forget marketing and advertising expenses to gain market share. These costs need to be weighed against the potential benefits of expansion. A well-executed expansion plan should lead to increased efficiency, higher production levels, and stronger relationships with key suppliers.

What fascinates me is how companies juggle these competing priorities. It’s a delicate balancing act between investing for future growth and maintaining current profitability. Investors need to carefully assess whether Resourceful Automobile is making prudent financial decisions. Speaking of which, have you seen how Mahindra is doing with revenue? Always good to compare.

Assessing Risks and Rewards in the Global Automobile Market

Let’s be real – expanding into new markets is not a walk in the park. There are numerous risks to consider. Political and economic instability, currency fluctuations, and changing consumer tastes can all throw a wrench in the works. Resourceful Automobile needs to conduct thorough market research to understand the specific challenges and opportunities in each target region. A common mistake I see people make is underestimating the importance of cultural differences.

What about the rewards, though? Successful geographic expansion can lead to significant revenue growth, increased market share, and enhanced brand recognition. And let’s not forget the potential for innovation. Exposure to new markets and new customer needs can spark new ideas and lead to the development of innovative products and services. What intrigues me is how companies use new ideas to maintain sustainable growth .

Ultimately, whether Resourceful Automobile’s geographic expansion is a winning strategy will depend on its execution. A well-planned and well-executed expansion can unlock significant value for shareholders. But a poorly conceived and poorly executed expansion can lead to financial distress. As per the guidelines mentioned in the information bulletin from the National Stock Exchange, investors should always perform their own due diligence. It’s not about blindly following the herd, but rather about making informed decisions based on your own research and analysis. Always keep track of the company performance .

FAQ Section

Frequently Asked Questions

What if Resourceful Automobile fails to expand successfully?

If the expansion fails, the company’s stock price could decline, and it might face financial difficulties. However, a single failed expansion doesn’t necessarily spell doom. The company can learn from its mistakes and adjust its strategy.

How does geographic expansion affect existing shareholders?

Successful expansion can benefit existing shareholders through increased stock price and dividends. However, failed expansion can negatively impact shareholder value.

What are some common pitfalls of geographic expansion?

Common pitfalls include underestimating cultural differences, failing to adapt products to local market needs, and not conducting thorough market research. Also, you need to look for companies with strong financials .

How can I stay informed about Resourceful Automobile’s expansion plans?

Follow the company’s press releases, financial reports, and industry news. Also, monitor stock market analysis from reputable sources.

What role does forming strategic partnerships play in geographic expansion?

Strategic alliances can provide local market knowledge, access to established distribution networks, and shared resources, reducing the risks and costs associated with entering new territories.

So, is Resourceful Automobile poised for growth through geographic expansion? Only time will tell. But by carefully analyzing the company’s strategy, financial metrics, and risk management practices, investors can make informed decisions. And that, my friend, is the name of the game. Ultimately, you want to assess if the company has an effective strategy to maintain its market position.