The Indian automotive industry is at a fascinating, albeit precarious, crossroads. We’ve seen incredible growth, disruptive innovation, and a growing awareness of the need for sustainable practices. But – and this is a big ‘but’ – several factors are converging to create a landscape ripe for potential missteps. So, it’s a critical time for course correction .

What fascinates me is how quickly the narrative can shift. One minute, everyone’s celebrating record sales figures; the next, they’re wringing their hands about supply chain bottlenecks and fluctuating consumer demand. It’s enough to give anyone whiplash. But let’s cut through the noise and examine the key challenges threatening the industry’s momentum – and, more importantly, explore strategies for navigating these turbulent waters. We need to understand the deeper “why” behind these shifts.

Understanding the Shifting Sands of the Automotive Sector

The Indian automotive landscape is a complex tapestry woven with threads of government policy, global economic trends, technological advancements, and – perhaps most importantly – the evolving preferences of the Indian consumer. Let’s break down some of the most significant pressure points:

- Supply Chain Disruptions: The pandemic exposed vulnerabilities in global supply chains, and the automotive sector was hit hard. Shortages of semiconductors, raw materials, and other critical components continue to plague manufacturers, leading to production delays and increased costs.

- Rising Input Costs: Inflationary pressures are pushing up the prices of everything from steel and aluminum to plastics and rubber. This, in turn, is squeezing profit margins for automakers and forcing them to pass on higher costs to consumers.

- Evolving Regulatory Landscape: The Indian government is actively promoting electric vehicles (EVs) and stricter emission norms. While these initiatives are commendable, they also require significant investments from automakers and create uncertainty about the future of traditional internal combustion engine (ICE) vehicles. Wikipedia’s article on the automotive industry provides a great overview.

- Changing Consumer Preferences: Indian consumers are becoming more discerning and demanding. They want fuel-efficient vehicles, advanced safety features, and connected car technologies. They are also increasingly open to considering EVs, but range anxiety and the lack of charging infrastructure remain significant barriers.

These factors create a perfect storm of challenges, requiring automakers to be agile, innovative, and strategic in their approach. So, what can they do? That’s the million-dollar question.

How to Navigate the Choppy Waters | A Practical Guide

Here’s the thing: simply reacting to market changes isn’t enough. Automakers need to proactively anticipate and shape the future. Here’s how, drawing from my experience observing the Indian auto sector:

- Diversify Supply Chains: Reduce reliance on single suppliers and explore alternative sourcing options. This is not just about mitigating risk but also about building resilience.

- Invest in R&D: Focus on developing innovative technologies, including EVs, hybrid vehicles, and alternative fuels. Stay ahead of the curve by anticipating future regulatory requirements and consumer demands.

- Embrace Digitalization: Leverage data analytics, artificial intelligence, and the Internet of Things (IoT) to optimize manufacturing processes, improve supply chain management, and enhance the customer experience. The automotive industry is rapidly becoming a tech industry.

- Strengthen Brand Loyalty: Focus on building strong relationships with customers by providing exceptional products, services, and experiences. Brand loyalty is a powerful differentiator in a competitive market.

- Advocate for Supportive Policies: Work collaboratively with the government to create a stable and predictable regulatory environment that fosters innovation and investment.

A common mistake I see companies make is underestimating the importance of the human element. Technology and efficiency are crucial, but ultimately, it’s about connecting with the customer on an emotional level. This is where storytelling and building a strong brand identity come into play. Check out GST reforms in the automobile sector .

The EV Revolution | Opportunity or Threat?

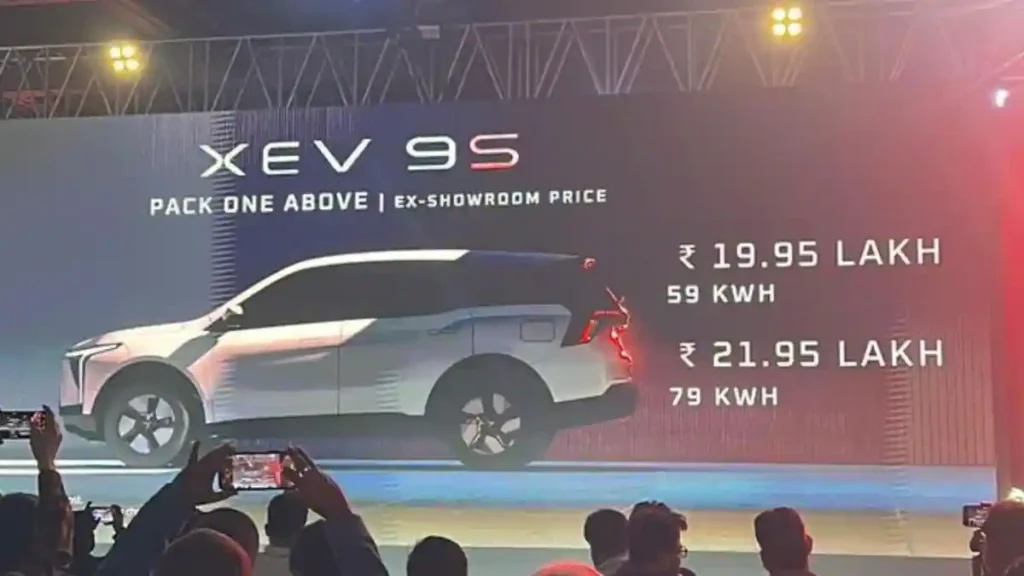

Electric vehicles are no longer a futuristic fantasy; they are a present-day reality. The Indian government has set ambitious targets for EV adoption, and several automakers have announced plans to launch new EV models in the coming years. But while the EV revolution presents significant opportunities, it also poses some serious challenges. One of the biggest obstacles is the lack of adequate charging infrastructure. Range anxiety is a real concern for potential EV buyers, and the government needs to invest heavily in building a nationwide network of charging stations. Another challenge is the high cost of EVs, which makes them inaccessible to many Indian consumers. Automakers need to find ways to reduce the cost of EVs without compromising on performance or safety. The EV market is certainly one to watch.

And then there’s the question of battery technology. The availability of raw materials, the environmental impact of battery production, and the need for efficient battery recycling are all critical considerations. It’s a complex puzzle with no easy answers.

The Indian Consumer | A Force to Be Reckoned With

Ultimately, the success of the Indian automotive package hinges on understanding and catering to the needs of the Indian consumer. They are value-conscious, demanding, and increasingly digitally savvy. Automakers need to offer products and services that are tailored to their specific requirements and preferences. This means focusing on fuel efficiency, affordability, safety, and connectivity. It also means providing a seamless and personalized customer experience, both online and offline. Let me rephrase that for clarity: understanding the Indian consumer is not just about selling cars; it’s about building relationships.

The rise of the used car market is another trend that automakers need to pay attention to. Many Indian consumers are opting to buy used cars instead of new ones, driven by affordability concerns and the availability of high-quality pre-owned vehicles. Automakers need to adapt their business models to capitalize on this trend, perhaps by offering certified pre-owned programs or partnering with used car marketplaces.

Looking Ahead | A Call for Collaboration and Innovation

The Indian automotive industry faces a challenging but exciting future. The path forward requires collaboration between automakers, government, and consumers. It also requires a relentless focus on innovation, sustainability, and customer satisfaction. I initially thought this was straightforward, but then I realized the depth of the issues at hand. The industry needs to embrace new technologies, business models, and partnerships to thrive in the years to come. Only then can it truly unlock its full potential and contribute to India’s economic growth and development. It’s about more than just cars; it’s about shaping the future of mobility.

FAQ

What are the biggest challenges facing the automotive industry in India?

Supply chain disruptions, rising input costs, evolving regulations, and changing consumer preferences are major hurdles.

How can automakers overcome these challenges?

Diversifying supply chains, investing in R&D, embracing digitalization, and strengthening brand loyalty are key strategies.

Is the EV revolution a threat or an opportunity?

It’s both. It offers significant opportunities for growth and innovation, but also poses challenges related to infrastructure and cost.

What role does the Indian consumer play in the automotive industry?

A crucial role. Understanding their needs and preferences is essential for success.

What’s the future of the automotive sector in India?

It’s promising but requires collaboration, innovation, and a focus on sustainability and customer satisfaction.

The road ahead won’t be easy. But with vision, determination, and a willingness to embrace change, the Indian automotive industry can navigate these challenges and emerge stronger and more resilient than ever before. And here’s the crucial point: the time for course correction is now.