Let’s be honest, predicting the stock market is like trying to forecast the monsoon in Mumbai – tricky, to say the least. But, hey, that’s what makes it exciting, right? We are diving deep into Resourceful Automobile Limited and whether its stock can continue its winning streak into YEAR. I’m not just throwing numbers at you; I’m trying to figure out if this company is built to last or just enjoying a temporary sugar rush. The aim is to provide investment analysis for the long-term investor.

Decoding the Cash Flow Conundrum

Cash flow is the lifeblood of any company. It’s not enough to just look at profits; you need to see where the money is coming from and where it’s going. A company can look profitable on paper but be bleeding cash – a dangerous situation. This is where a detailed cash flow statement analysis comes into play. In the case of Resourceful Automobile Limited, let’s dig into their latest financials. What I want to see is consistent positive cash flow from operations. Are they actually generating cash from selling cars and services, or are they relying on debt or asset sales? A common mistake I see investors make is ignoring this crucial aspect. They get blinded by impressive revenue growth, but that growth means nothing if it’s not translating into cold, hard cash.

Look at it this way. Imagine you’re running a small business. You might have tons of sales, but if your customers aren’t paying you on time, or if you’re spending more than you’re earning, you’re heading for trouble. The same principle applies to Resourceful Automobile Limited. We’ll need to scrutinize their financial statements to see if they’re managing their cash effectively.

Low Investment Growth | A Red Flag or a Smart Strategy?

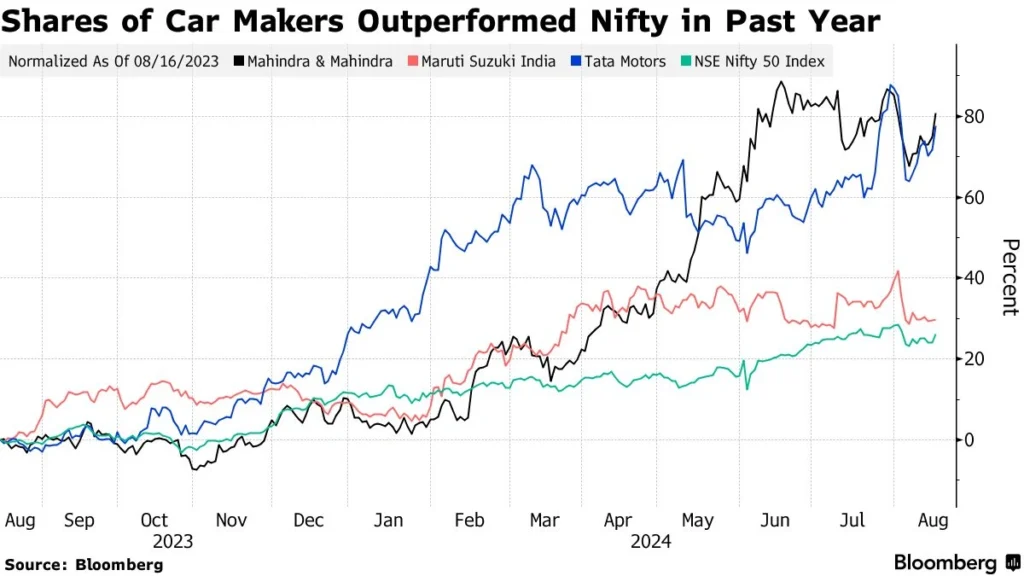

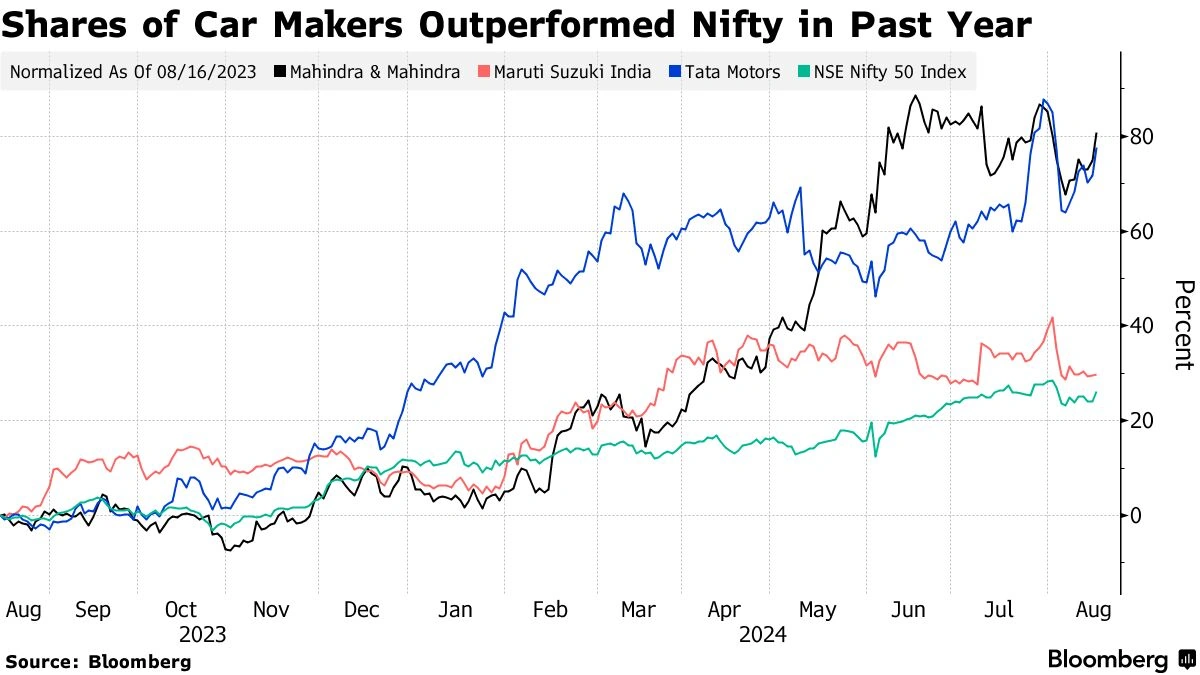

Now, about this “low investment growth” thing. At first glance, it might seem like a negative. Why isn’t the company investing more in its future? Are they becoming complacent? Are competitors gaining ground? Well, not so fast. Sometimes, not investing heavily can be a sign of fiscal discipline. Maybe Resourceful Automobile Limited is focusing on maximizing efficiency and squeezing every last rupee out of its existing assets. Or maybe their strategy is focused on shareholder value rather than aggressive expansion. So, the answer to automobile stock outperformance can be complex. Bolero and Mahindra will provide challenges to the stock price.

Here’s the thing: we need to understand why they’re not investing more. Are they facing constraints? Are they choosing to return cash to shareholders through dividends or buybacks? Or are they simply content with their current market position? A deep dive into their capital expenditure plans and investor presentations is essential. It is important to track investor sentiment to predict stock market performance. What fascinates me is how a company’s narrative – the story they tell investors – can influence its stock price just as much as the actual numbers.

The Competitive Landscape and Market Trends

Resourceful Automobile Limited doesn’t exist in a vacuum. They’re battling it out in a fiercely competitive market, and changes in the industry can significantly impact their prospects. Let’s consider a few factors:

- Electric Vehicle (EV) Transition: Is Resourceful Automobile Limited embracing electric vehicles? Are they investing in battery technology? Or are they lagging behind, clinging to traditional combustion engines?

- Changing Consumer Preferences: Are Indian consumers shifting towards SUVs, hatchbacks, or sedans? Is Resourceful Automobile Limited adapting its product lineup to meet these changing demands?

- Government Regulations: Are there new emission standards or safety regulations that could impact Resourceful Automobile Limited’s manufacturing costs or sales?

These are just a few of the external factors that could influence the company’s future performance. You have to track global auto sales data.

The Importance of Financial Ratios

Let’s talk about financial ratios. These are tools that help us to assess a company’s financial health and performance. Here are a few key ratios to consider when analyzing Resourceful Automobile Limited:

- Price-to-Earnings (P/E) Ratio: How much are investors willing to pay for each rupee of earnings? A high P/E ratio could indicate that the stock is overvalued, while a low P/E ratio could suggest that it’s undervalued.

- Debt-to-Equity Ratio: How much debt is the company using to finance its operations? A high debt-to-equity ratio could indicate that the company is taking on too much risk.

- Return on Equity (ROE): How effectively is the company using its shareholders’ equity to generate profits? A high ROE is generally a good sign.

These ratios, when compared to those of its competitors and to industry averages, can provide valuable insights into Resourceful Automobile Limited’s relative strengths and weaknesses.

Scenario Planning | What Could Go Wrong?

No analysis is complete without considering the potential downsides. What are the risks that could derail Resourceful Automobile Limited’s outperformance? Here are a few possibilities:

- Economic Slowdown: A recession or economic slowdown could reduce consumer spending on automobiles, hurting the company’s sales.

- Increased Competition: New entrants or aggressive moves by existing competitors could erode Resourceful Automobile Limited’s market share.

- Supply Chain Disruptions: Disruptions in the supply chain (like the global semiconductor shortage) could increase production costs and reduce sales.

- Poor Management Decisions: A bad acquisition, a failed product launch, or a strategic blunder could damage the company’s reputation and its stock price.

It’s crucial to think about these risks and assess how well Resourceful Automobile Limited is prepared to handle them.

In conclusion, determining whether Resourceful Automobile Limited’s stock will continue to outperform is a complex question that requires a thorough analysis of its cash flow, investment strategy, competitive landscape, and financial ratios, along with consideration of potential risks. Automobile market trends will play a huge role in the outcome. Don’t just follow the herd; do your homework and make informed decisions. And remember, past performance is not necessarily indicative of future results. Mercedes Benz cars are an excellent example of top stock brands.

FAQ

What if I’m new to investing?

Start small, do your research, and don’t put all your eggs in one basket. Diversification is key.

How often should I check my stock portfolio?

It depends on your investment strategy. Long-term investors might only check once a month, while active traders might check daily.

What are the tax implications of selling stock?

Capital gains tax applies to profits from selling stock. Consult a tax advisor for specific advice.

Where can I find reliable financial information about Resourceful Automobile Limited?

Check their investor relations website, annual reports, and reputable financial news sources.

What role do interest rate changes play in stock prices?

Rising rates often lead to lower stock prices, particularly for companies with significant debt.