Let’s talk about something that might sound drier than a week-old chapati: balance sheets . But hold on, because if you’re even remotely interested in the financial health of companies – especially one like Automobile & PCB (KRX:015260), a South Korean firm with its fingers in both the automotive and printed circuit board pies – then understanding their financial position is absolutely crucial. Think of it as a health check-up for a company. Are they thriving, just surviving, or heading for the financial ICU? Today, we’re diving deep to analyze their financial stability .

Here’s the thing: just glancing at headlines or quarterly reports won’t cut it. We need to roll up our sleeves and understand the story the balance sheet is telling. And trust me, every company has a story.

Why Should You Care About Automobile & PCB’s Balance Sheet?

Okay, so maybe you’re not planning on investing millions in KRX:015260. But understanding the stability of a company like this matters for a few reasons. First, it’s a great case study. A company straddling two very different industries – automobiles and electronics – faces unique challenges. How well they manage their assets and liabilities speaks volumes about their leadership and strategy. Second, if you are considering investing, or even if you’re just a customer who relies on their products, you want to know they’ll be around for the long haul. The financial leverage they are under is an important factor to consider before investing.

And here’s the kicker: in today’s volatile global economy, companies that appear strong on the surface can crumble quickly if their financial foundations are shaky. So, learning to read a balance sheet isn’t just for finance nerds; it’s a vital skill for anyone navigating the modern world.

Decoding the Key Components | What to Look For

A balance sheet , at its core, is a snapshot of a company’s assets , liabilities , and equity at a specific point in time. Think of it as a photograph of the company’s financial standing. Let’s break down each element:

- Assets: What the company owns. This includes everything from cash and accounts receivable (money owed to them) to inventory, equipment, and property. A high proportion of liquid assets – things easily converted to cash – is generally a good sign.

- Liabilities: What the company owes. This includes accounts payable (money they owe to others), salaries, loans, and other debts. Keeping an eye on the debt-to-equity ratio is key here.

- Equity: The owners’ stake in the company. It’s essentially what’s left over if you subtract liabilities from assets. A growing equity base suggests the company is building value.

Now, simply looking at these numbers in isolation doesn’t tell the whole story. We need to dig deeper and analyze the relationships between them.

Red Flags and Green Lights | What the Ratios Tell Us

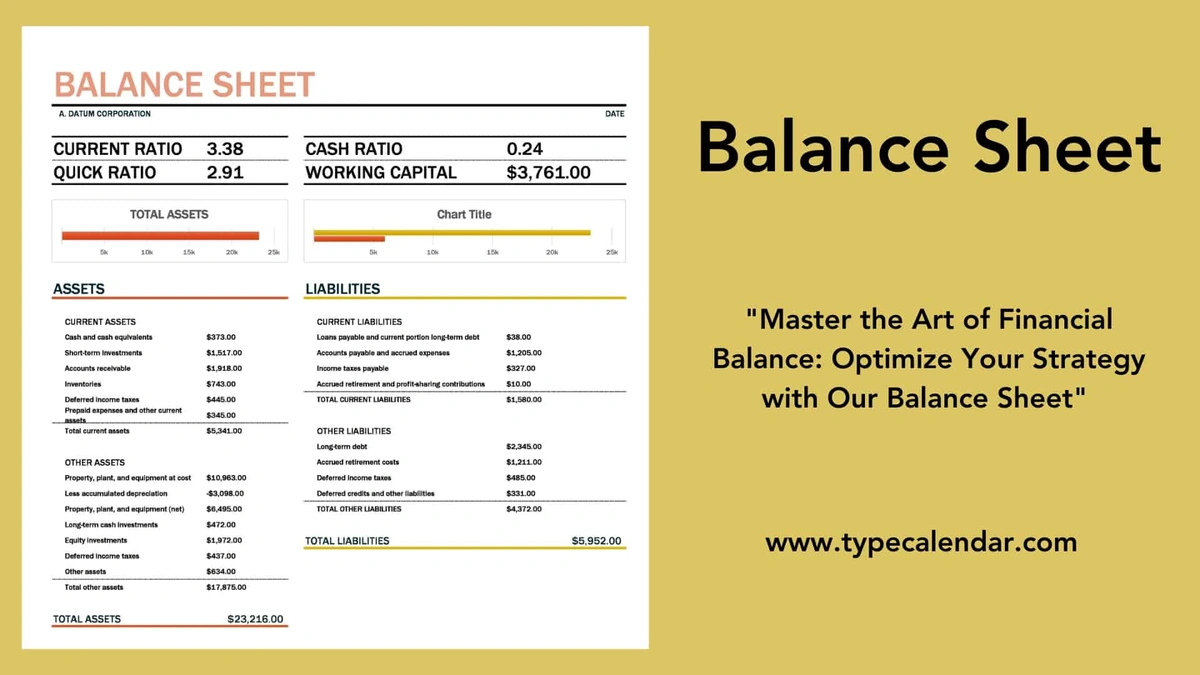

This is where the fun begins! Financial ratios are like the vital signs of a company. They help us assess its health in a more meaningful way. Here are a few key ratios to consider when evaluating Automobile & PCB (KRX:015260)’s balance sheet :

- Current Ratio: Current Assets / Current Liabilities. A ratio above 1 suggests the company has enough liquid assets to cover its short-term obligations. But a very high ratio could also indicate that the company isn’t efficiently using its assets.

- Debt-to-Equity Ratio: Total Debt / Total Equity. This ratio shows how much the company is relying on debt to finance its operations. A high ratio can be risky, but it depends on the industry and the company’s specific circumstances.

- Quick Ratio (Acid-Test Ratio): (Current Assets – Inventory) / Current Liabilities. This is a more conservative measure than the current ratio, as it excludes inventory, which may not be easily converted to cash.

A common mistake I see people make is focusing solely on one ratio in isolation. You need to look at the overall picture and consider the company’s industry, its competitors, and its historical performance. As per the guidelines mentioned in the information bulletin, you have to always consider additional factors that could impact a company. For example, is the company in the middle of an expansion? Are there any upcoming regulatory changes that could affect its profitability?

The Automobile & PCB Context | A Unique Balancing Act

Here’s where things get really interesting. Automobile & PCB (KRX:015260) operates in two very different industries, each with its own set of challenges and opportunities. The automobile industry is capital-intensive, requiring significant investments in manufacturing facilities and R&D. The PCB industry, on the other hand, is more technology-driven and faces constant pressure to innovate. So, how does the company manage this balancing act? That’s the million-dollar question.

We need to analyze how the company allocates its capital between these two divisions. Is it investing heavily in electric vehicles (EVs), a booming sector? Or is it focusing on high-margin PCBs for specialized applications? The answers to these questions will give us clues about its long-term strategy and its ability to adapt to changing market conditions.

But, understanding the electrification of cars is crucial for analyzing their automobile division. A transition towards this will change the way the company works. And how they are dealing with it now will have an effect on their financial position .

Looking Ahead | What the Future Holds

Ultimately, analyzing Automobile & PCB (KRX:015260)’s balance sheet is about more than just crunching numbers. It’s about understanding the company’s strategy, its risk tolerance, and its ability to navigate a complex and ever-changing world. Are they positioned to thrive in the future, or are they facing significant headwinds? That’s the question we’re trying to answer.

And here’s my final thought: don’t be intimidated by financial statements. They’re just a tool – a powerful one, but a tool nonetheless. With a little bit of knowledge and a healthy dose of skepticism, you can unlock valuable insights and make more informed decisions, whether you’re an investor, a customer, or simply someone who wants to understand the world a little better. Before making any rash investment decisions, it is important to do some extra research. You should also check other stocks that might yield higher returns.

FAQ Section

Frequently Asked Questions

What does the current ratio tell me about a company?

The current ratio (Current Assets / Current Liabilities) indicates a company’s ability to cover its short-term debts with its short-term assets. A ratio above 1 generally suggests sufficient liquidity.

Is a high debt-to-equity ratio always bad?

Not necessarily. While a high debt-to-equity ratio can indicate higher risk, it depends on the industry and the company’s specific circumstances. Some industries naturally require more debt financing.

Where can I find Automobile & PCB (KRX:015260)’s balance sheet?

You can typically find a company’s balance sheet in its annual report, which is usually available on the company’s website or through financial data providers.

What if I don’t understand all the terms on the balance sheet?

Don’t worry! There are plenty of resources available online to help you understand financial terms. Investopedia is a great place to start.

How often should I review a company’s balance sheet?

Reviewing a company’s balance sheet at least annually is a good practice. However, if there are significant events or changes in the company’s industry, you may want to review it more frequently.