Okay, let’s be honest. Figuring out whether a company can keep paying those sweet, sweet dividends – especially in today’s crazy economic climate – feels a bit like predicting the monsoon. You’ve got to look at all sorts of signs, from the blustering winds of market sentiment to the subtle humidity of financial statements. But here’s the thing: it’s not impossible. We can arm ourselves with the right knowledge. Let’s dive into how to assess a company’s dividend payout ratio and its ability to maintain those dividends even when things get tough.

Decoding the Dividend Payout Ratio | It’s More Than Just a Number

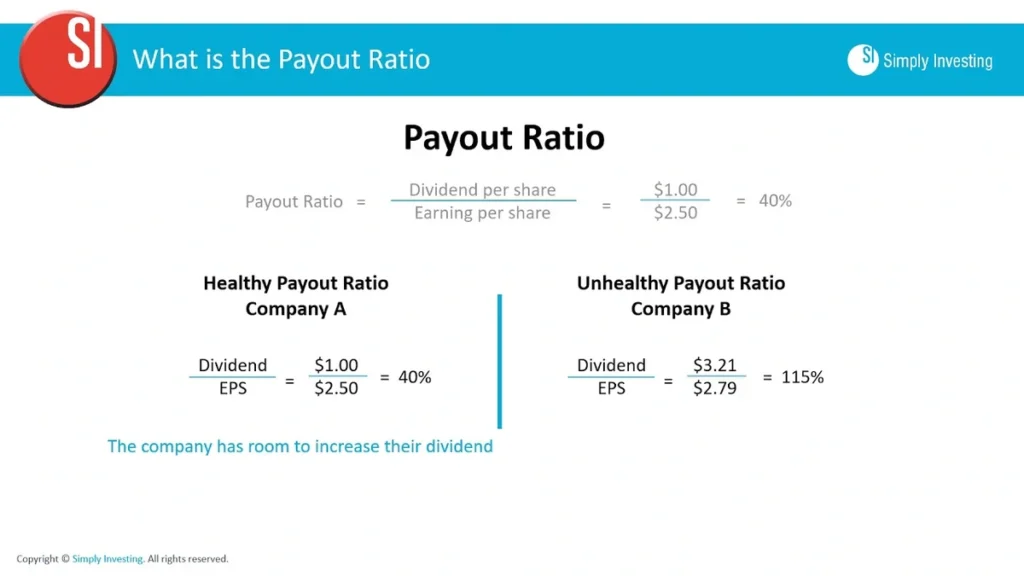

The dividend payout ratio . Sounds intimidating, right? It isn’t, really. At its core, it’s simply the percentage of a company’s earnings that it pays out as dividends. Think of it as the company sharing its profits with its shareholders, like splitting a samosa with your best friend. A high payout ratio might suggest a company is generous, but it could also signal they’re struggling to reinvest in growth. A low ratio? They might be hoarding cash for future expansion or weathering a storm. What fascinates me is the story this ratio tells about the company’s priorities and financial health.

Now, how do you actually calculate this magic number? It’s pretty straightforward:

- Find the company’s total dividends paid out. This info is usually in their annual report.

- Find the company’s net income (also in the annual report).

- Divide the total dividends by the net income.

- Multiply by 100 to get a percentage.

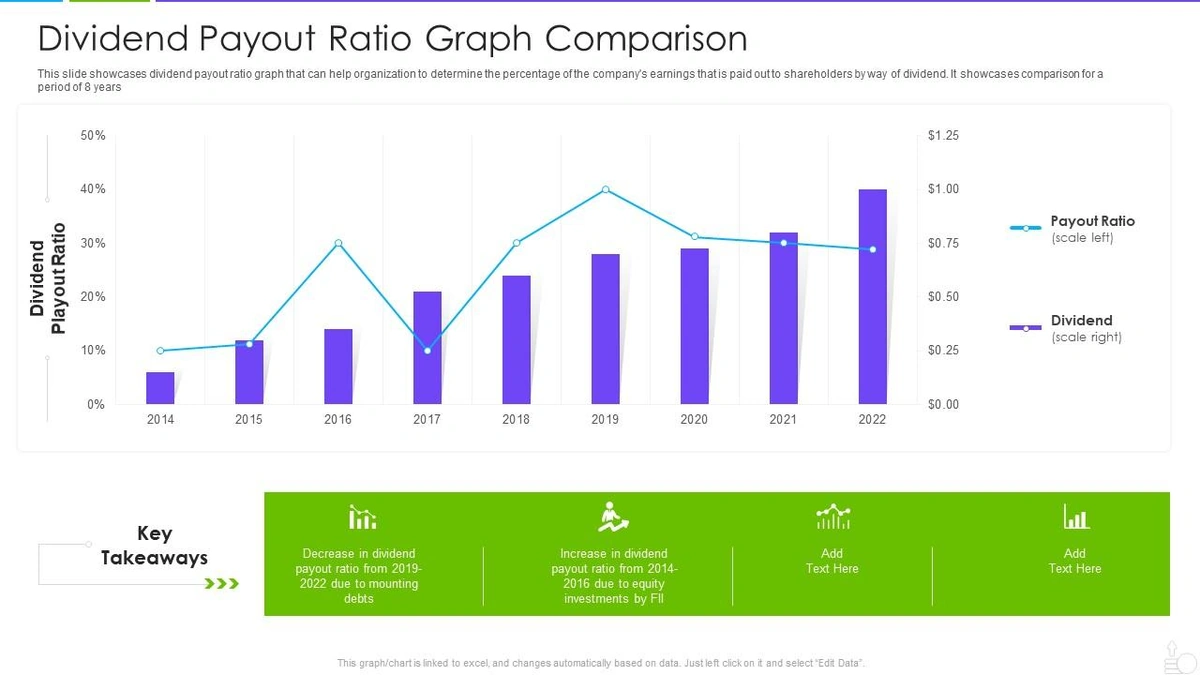

Boom. You’ve got your dividend payout ratio . But remember, this is just one piece of the puzzle. The real fun begins when you start comparing it to other companies in the same industry and analyzing it over time.

Economic Headwinds and Automobile Industry | A Stress Test for Dividends

The automobile industry is cyclical. Boom times, followed by periods of consolidation. Add in global economic uncertainty – inflation, supply chain disruptions, the rise of EVs – and suddenly, those previously reliable dividend payouts look a little less certain. Here’s where we need to put on our analyst hats. A company’s ability to sustain its dividend hinges on its ability to generate consistent cash flow, even when sales slow down. What I see often overlooked is the impact of raw material price fluctuations. Steel, aluminum, and those precious battery components – their prices can swing wildly, impacting profitability.

And speaking of EVs, the transition to electric vehicles is a massive capital undertaking. Companies need to invest heavily in research, development, and new manufacturing facilities. This can put a strain on their finances and potentially impact their ability to maintain dividend payouts. The smart companies are finding ways to balance these investments with their commitment to shareholders. But those that are slow to adapt or overextend themselves? Well, their dividend sustainability might be in jeopardy. It’s an interesting tightrope walk they are on, isn’t it?

Let me rephrase that for clarity. We’re not just talking about surviving. It is also about thriving. Consider the impact of market signals , like shifts in consumer preferences and regulatory changes. Companies that are ahead of the curve – those that anticipate these changes and adapt their strategies accordingly – are more likely to maintain their dividend payouts over the long term. Remember to consider market trends too.

Beyond the Ratio | Holistic View on Financial Metrics

The dividend payout ratio is a great starting point, but it doesn’t tell the whole story. We need to dig deeper and look at other key financial metrics to get a complete picture of a company’s financial health. Think of it like this: the ratio is the appetizer, but the main course is a comprehensive analysis of the company’s financials.

Here are a few key metrics to consider:

- Free Cash Flow: This is the cash a company generates after accounting for capital expenditures. It’s a crucial indicator of a company’s ability to fund its dividends.

- Debt Levels: High debt levels can put a strain on a company’s finances and make it more difficult to maintain dividend payouts.

- Earnings Growth: Consistent earnings growth is essential for long-term dividend sustainability.

- Return on Equity (ROE): ROE measures how efficiently a company is using its shareholders’ equity to generate profits. A higher ROE generally indicates a more profitable and sustainable business.

I initially thought this was straightforward, but then I realized the importance of looking at these metrics in conjunction with the payout ratio . For example, a company with a high payout ratio and strong free cash flow might be in a better position to sustain its dividend than a company with a low payout ratio but weak cash flow. Always consider the whole picture.

Spotting Warning Signs | Is Your Dividend in Danger?

Okay, let’s get practical. What are some red flags that might indicate a company’s dividend is in trouble? Here are a few things to watch out for:

- Declining Earnings: This is the most obvious warning sign. If a company’s earnings are consistently declining, it will eventually become difficult to maintain its dividend payout.

- Increasing Debt: A rapid increase in debt levels can put a strain on a company’s finances and make it more vulnerable to economic downturns.

- High Payout Ratio: A consistently high payout ratio (especially above 75%) can indicate that a company is not reinvesting enough in its business.

- Industry Disruptions: Companies in industries facing significant disruptions (like the shift to EVs) may be more likely to cut their dividends.

According to Investopedia Learn More , the dividend payout ratio should be measured relative to a company’s peers.

What fascinates me is how these warning signs often appear gradually, like the slow onset of a health problem. If you’re paying attention, you can often spot them early and take action before it’s too late. Remember, it’s better to be safe than sorry when it comes to your investments.

A common mistake I see people make is ignoring these warning signs because they’re attached to the dividend income. Don’t let your emotions cloud your judgment. Investing is a rational game, and it’s important to make decisions based on facts and analysis, not hope.

Future-Proofing Your Portfolio | Focus on Sustainable Dividends

So, how can you build a portfolio of dividend-paying stocks that can withstand economic changes and market volatility? The key is to focus on sustainability. Look for companies with a track record of consistent earnings growth, strong free cash flow, and reasonable debt levels. And don’t be afraid to diversify. Spreading your investments across different industries can help reduce your overall risk.

A lot of investors fall into the trap of chasing high yields. But here’s the thing: a high yield is often a sign of risk. Companies that offer unusually high yields may be doing so because their stock price has fallen due to concerns about their financial health. It’s better to focus on companies with sustainable dividends, even if the yield is lower. I see long-term trends as important here.

Here’s the thing: investing in dividend stocks is a long-term game. It’s not about getting rich quick. It’s about building a steady stream of income that can help you achieve your financial goals. So, be patient, do your research, and focus on sustainability. And remember, even the most well-researched investments can face unexpected challenges. The key is to be prepared and to adjust your strategy as needed.

FAQ

What if I’m new to investing and find all this financial jargon confusing?

No worries! Start small. Focus on understanding the basics, like the dividend payout ratio and free cash flow. There are tons of resources online – Investopedia is a great place to start. And don’t be afraid to ask for help from a financial advisor.

Is a high dividend payout ratio always a bad thing?

Not necessarily. It depends on the company and its industry. Some mature companies with stable earnings may be able to sustain high payouts. But it’s important to dig deeper and assess the company’s overall financial health.

How often should I review my dividend portfolio?

At least once a year, but preferably more often. Keep an eye on your companies’ earnings reports, industry trends, and any news that could impact their financial health.

What are some good resources for researching dividend stocks?

Financial websites like Bloomberg, Yahoo Finance, and Google Finance offer a wealth of information on dividend stocks. You can also find helpful analysis from brokerage firms and independent research providers.

Should I only invest in dividend stocks?

Probably not. Diversification is key to managing risk. Consider including a mix of growth stocks, bonds, and other asset classes in your portfolio.

Can a company suddenly stop paying dividends?

Yes, absolutely. Dividends are not guaranteed. Companies can cut or suspend their dividends at any time, especially during times of economic hardship.

In conclusion, understanding dividend sustainability in the automobile industry, especially amidst economic changes, requires a holistic approach. It’s not just about the numbers; it’s about understanding the company’s strategy, its ability to adapt, and its commitment to rewarding shareholders in a sustainable way. So, do your homework, stay informed, and remember that investing is a marathon, not a sprint. Now, go forth and build that resilient dividend portfolio!