The Indian auto market is a beast. A massive, roaring, ever-evolving beast. We see the headlines: sales figures are up, new models are launching, electric vehicles are gaining traction. But, as an investor sitting here with my chai, the real question is: can we actually make money from auto stocks right now? Let’s be honest, the answer isn’t as straightforward as the car ads make it seem.

Forget the hype for a second. We need to dissect what’s really driving the market and, more importantly, whether that momentum translates into long-term gains for investors like you and me. I initially thought this was just about EV adoption, but then I realized there’s so much more under the hood – supply chain resilience, government policies, and shifting consumer preferences all play a huge role. So, let’s buckle up and dive in. We will discuss the Indian automotive industry , stock market analysis , and specific companies like Maruti Suzuki India .

Decoding the Current Auto Landscape

So, what’s really happening? The auto sector is experiencing a mixed bag of tailwinds and headwinds. On one hand, we’ve got pent-up demand from the pandemic era, a growing middle class with disposable income, and increasing infrastructure development that’s making car ownership more appealing, especially in tier-2 and tier-3 cities. For instance, auto sales in Western India have seen a significant boom. But, and it’s a big but, rising raw material costs (steel, aluminum, precious metals used in catalytic converters), semiconductor shortages (though easing, they’re still a factor), and the ever-present threat of inflation are throwing wrenches into the works. Let me rephrase that for clarity: the demand is there, but profitability is being squeezed.

Consider Maruti Suzuki India , the undisputed king of the Indian car market. They’ve got brand recognition, a massive service network, and a reputation for reliability. However, they’ve been relatively slow to embrace electric vehicles compared to some of their competitors. M&M, on the other hand, is aggressively pushing into the EV space with models like the XUV400. And Bajaj, while primarily known for two and three-wheelers, is also exploring electric mobility solutions. The crucial thing to consider is that EV transition costs a lot of money.

The EV Disruption and Its Impact on Auto Stocks

The electric vehicle revolution is no longer a distant dream; it’s happening right now. And it’s fundamentally reshaping the automotive landscape. Here’s the thing: legacy automakers are facing a massive challenge – they need to invest heavily in EV technology while simultaneously managing their existing internal combustion engine (ICE) businesses. That’s a capital-intensive balancing act, and not everyone will succeed. As per the data fromStatista, electric vehicle sales are expected to grow rapidly in India, so investments are paramount. But, the EV transition is not without its hurdles. Range anxiety, charging infrastructure limitations, and the higher upfront cost of EVs are still major barriers for many potential buyers. The success of automakers in this space hinges on their ability to address these concerns and offer compelling EV products at competitive prices.

What fascinates me is how different companies are tackling this disruption. Some are going all-in on EVs, others are taking a more cautious approach, focusing on hybrid technologies and alternative fuels. There’s no one-size-fits-all answer, and the market will ultimately decide who gets it right.

Financial Health and Key Metrics to Watch

Okay, let’s talk numbers. Before you even think about investing in auto stocks , you need to roll up your sleeves and analyze their financial statements. Here are some key metrics I always look at:

- Revenue growth: Is the company actually selling more vehicles?

- Profit margins: How efficiently are they converting sales into profits?

- Debt levels: Are they carrying too much debt on their balance sheet?

- Return on equity (ROE): How effectively are they generating profits from shareholders’ investments?

- Cash flow: Are they generating enough cash to fund their operations and investments?

A common mistake I see people make is focusing solely on revenue growth without considering profitability. A company can be selling a lot of cars, but if they’re doing so at a loss, it’s not a sustainable business model. Also, pay close attention to their capital expenditure (capex) plans. Automakers need to invest heavily in research and development, new product launches, and manufacturing facilities to stay competitive. Can they afford it?

Comparative Analysis | Maruti, M&M, and Bajaj

Let’s put these principles into practice. Maruti Suzuki India , with its strong market share and efficient operations, has historically been a consistent performer. New car launches and facelifts can always affect the valuation of companies. However, their relatively slow pace of EV adoption is a concern. M&M, on the other hand, is aggressively pursuing the EV market, but they need to demonstrate that they can successfully scale up their EV operations and achieve profitability. Bajaj Auto is also navigating the electric vehicle transition .

Each company has its own strengths and weaknesses. The key is to understand these nuances and assess whether their strategies align with your investment goals and risk tolerance. I initially thought this was straightforward, but then I realized it depends on how much risk one wants to take.

Long-Term Investment Outlook

So, are auto stocks a good investment now ? The answer, as always, is it depends. The Indian auto market has immense potential, but it’s also facing significant challenges. The EV disruption, rising costs, and evolving consumer preferences are creating a dynamic and uncertain environment. Let me rephrase that for clarity: It’s a high-risk, high-reward situation.

If you’re a long-term investor with a high-risk tolerance, then selectively investing in companies with strong fundamentals, a clear EV strategy, and a proven track record could be a rewarding proposition. However, it’s crucial to do your homework, stay informed about the latest developments in the industry, and be prepared for volatility. Don’t put all your eggs in one basket – diversification is key.

FAQ

Frequently Asked Questions

What are the key risks associated with investing in auto stocks?

Some key risks include economic slowdowns impacting demand, rising raw material costs, technological disruptions (especially related to EVs), and regulatory changes.

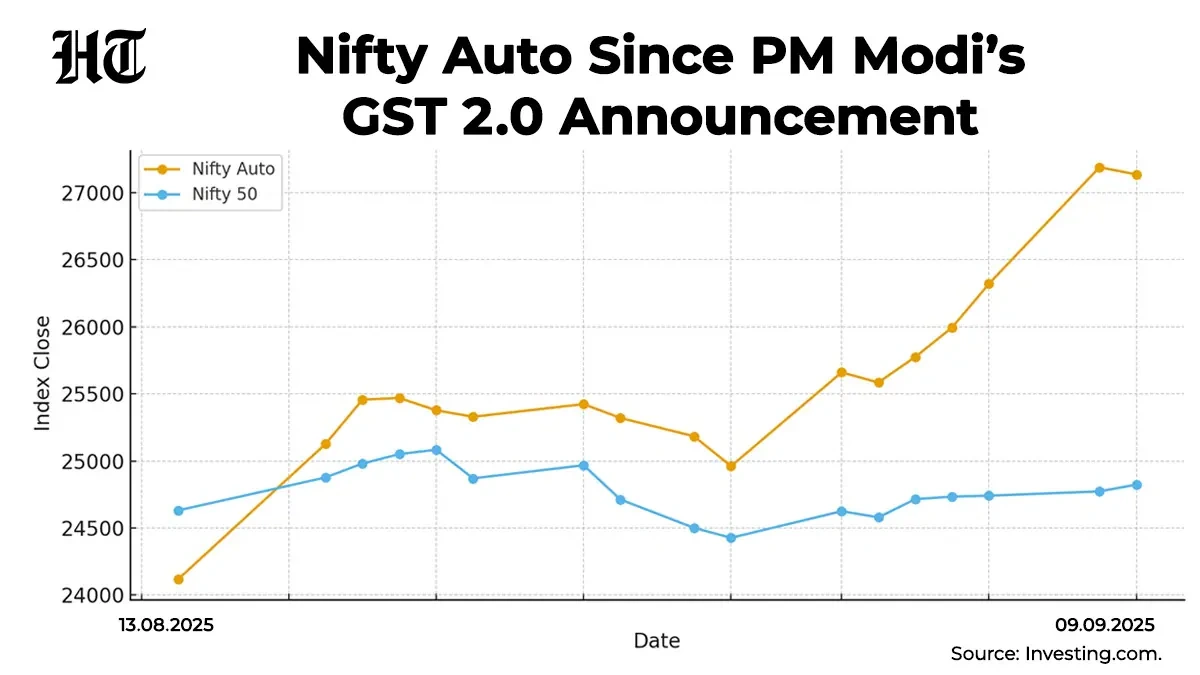

How does government policy affect auto stocks?

Government policies like fuel efficiency standards, EV subsidies, and infrastructure investments can significantly impact the competitiveness and profitability of automakers.

What role do commodity prices play in the profitability of auto companies?

Commodity prices, especially steel, aluminum, and precious metals used in catalytic converters, have a significant impact on the cost of production for automakers.

How important is it to consider the EV strategy of an auto company?

In today’s environment, assessing an auto company’s EV strategy is crucial, as the transition to electric vehicles is reshaping the industry landscape.

Which are some related sectors that move in tandem with the auto sector?

The auto ancillary, metal, and finance sectors often move in tandem with the auto sector, as they are closely linked to the automotive value chain.

One final thought: The Indian auto market is not a monolith. There are segments within segments, niches within niches. Understanding these micro-trends – the rise of SUVs, the growing popularity of automatic transmissions, the increasing demand for connected car features – can give you an edge in identifying potential winners.