Okay, let’s be real. When you see a headline like “API reports Rs 0.48 crore standalone net loss in Q2 2026,” your first thought probably isn’t, “Wow, I need to dive deep into the intricacies of this.” But here’s the thing: these kinds of financial reports, especially for publicly traded companies, are like little breadcrumbs that can lead to big insights. So, let’s grab that magnifying glass and see what we can uncover. We’ll do it together, alright?

Why This Tiny Net Loss Matters (More Than You Think)

A Rs 0.48 crore net loss might seem like a drop in the bucket, especially when we’re talking about companies that often deal in crores. But focusing solely on the number is like judging a book by its cover. To truly understand its impact, we need to look at the context. Was this an expected loss? Is it part of a larger trend? What does it signal about the company’s future strategies?

Often, a small net loss like this can be a strategic move. Companies sometimes take a short-term hit to invest in long-term growth. Think of it like planting a seed: you might not see immediate results, but with proper nurturing, it can blossom into something substantial. This analogy works well. But, and this is a big but, it’s also essential to be cautious. Is the company blaming external factors (like, say, global supply chain issues) or are there deeper, internal problems at play?

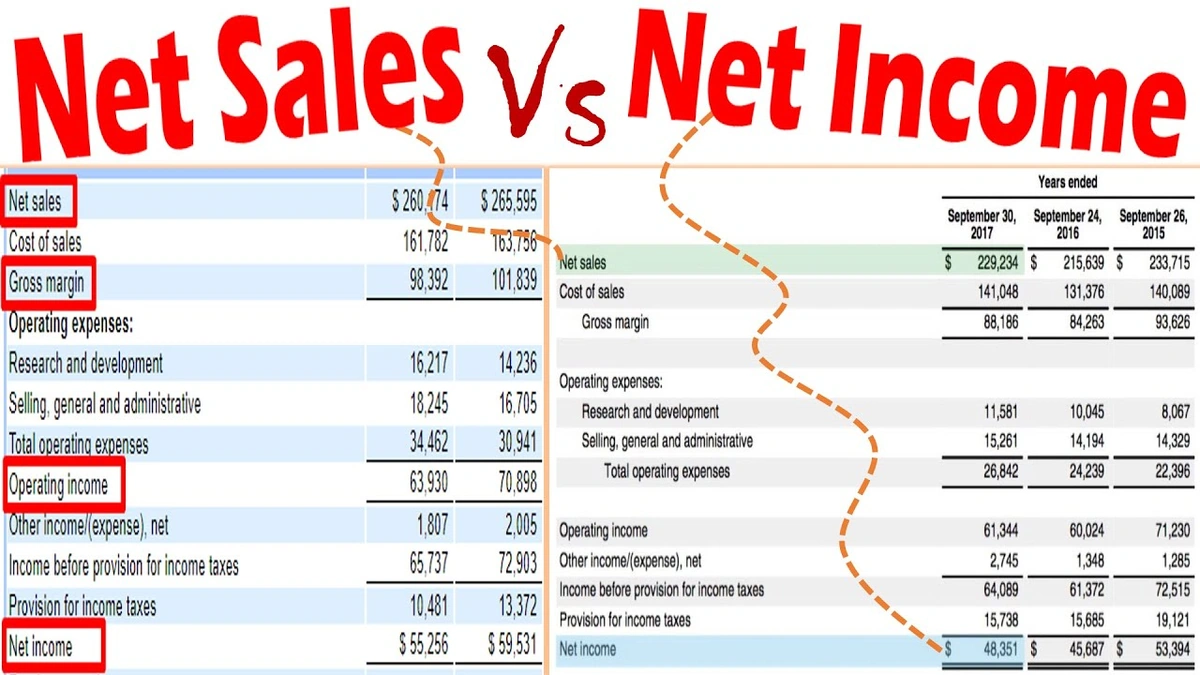

Digging into the financial statements, (which, let’s be honest, aren’t exactly bedtime reading material for most people) can reveal some clues. Are operating expenses skyrocketing? Is revenue stagnant? Or is this simply a one-time blip due to an unforeseen circumstance? Remember, the devil is always in the details.

Decoding the Standalone Numbers | What Does It Really Mean?

The term “standalone” is also key here. It means we’re looking at the performance of API (let’s assume it’s a specific company for now, like, say, Acme Pharmaceuticals India) as an individual entity, not as part of a larger consolidated group. This can be useful because it gives us a clear picture of how this specific arm of the company is performing, without the numbers being diluted or skewed by the performance of other subsidiaries or divisions. It’s like focusing on one branch of a tree to see if it’s bearing fruit, rather than looking at the whole tree at once.

But, there’s also a downside to looking at standalone figures. It might not give you the complete picture. For instance, Acme Pharmaceuticals India might be struggling as a standalone entity, but the parent company could be propping it up with resources or shifting profits around to make it look better overall. To get a truly comprehensive view, you’d need to analyze the consolidated financial statements as well.

And what about the Q2 2026 part? Well, that’s simply the timeframe we’re looking at. It’s important to compare this quarter’s performance with previous quarters, as well as with the same quarter in previous years. Are we seeing a consistent pattern of losses, or is this a sudden anomaly? The trend is your friend, as they say in the stock market.

How to Interpret Net Loss for Your Investments (or Just Your Curiosity)

So, what do you do with all this information? Well, if you’re an investor, a small net loss shouldn’t necessarily send you running for the hills. But it should prompt you to do some more digging. Read the management’s commentary in the annual report, listen to investor calls, and see what analysts are saying. Are they optimistic about the company’s future prospects? Or are they raising red flags?

Even if you’re not an investor, understanding these financial reports can be fascinating. It gives you a peek into the inner workings of the business world and helps you understand how companies are navigating the ever-changing economic landscape. This knowledge has value. Think of it as learning a new language; the more you understand it, the more you can decipher the world around you.

The key takeaway here is context. A net loss of Rs 0.48 crore in Q2 2026 is just a number. It’s what that number represents that truly matters. And that’s what makes financial analysis so compelling. It’s not just about crunching numbers; it’s about understanding the story behind them.

LSI Keywords and Their Integration

When analyzing the financial health of a company, it’s crucial to consider several key performance indicators (KPIs). Metrics such as revenue growth , operating margin , and debt-to-equity ratio provide a comprehensive view of the company’s financial status. Examining these factors alongside the net profit margin can offer deeper insights into the efficiency and profitability of the business. It’s equally important to analyze the cash flow statement to understand the company’s liquidity and ability to meet its short-term obligations. Reviewing the balance sheet helps in assessing the assets, liabilities, and equity of the company. Moreover, keeping an eye on market capitalization and earnings per share (EPS) can give you an understanding of the company’s valuation in the stock market. These LSI keywords offer a holistic understanding and help provide better results.

FAQ About Interpreting Financial Losses

What does a standalone net loss actually mean for the average person?

It means the company spent more than it earned during that quarter, but it’s a snapshot, not the whole story. Look at the trends and reasons behind it!

Is a net loss always a bad sign?

Not necessarily. Sometimes companies strategically take a loss to invest in future growth.

How can I find more information about why a company had a net loss?

Check their official reports, investor calls, and reputable financial news outlets.

What if I don’t understand any of these financial terms?

Start with the basics! There are tons of free resources online to help you understand financial literacy.

So, next time you see a headline about a company reporting a loss, don’t just gloss over it. Take a moment to dig a little deeper. You might be surprised at what you find. And remember, knowledge is power (and potentially profit!). You can look up additional information here .